Stock Market Trends guide investors as they gauge risk, opportunities, and potential portfolio shifts across different asset classes and time horizons for portfolios spanning equities, fixed income, and alternatives. By studying stock market indicators and performing a disciplined market trend analysis, you can separate noise from signal, discern underlying momentum, plan contingencies for volatile periods, and build a robust framework for navigating uncertainty today. Read stock market trends today to spot momentum, breadth, and sector leadership that shape entry points, risk controls, and long-term allocation decisions, especially across different market cycles and longer horizons. These insights support investing strategies for stock market trends and help you position for gains while managing risk through diversified exposure, cost-conscious implementation, and disciplined position sizing. This approach also clarifies how to identify market trends so you can build a resilient, long-term plan that adapts to changing macro conditions and evolving market regimes, including stress-testing scenarios.

From an LSI perspective, the topic can be framed using related signals like equity market momentum, price action, breadth, and macro drivers that shape trend directions. Consider terms such as price trends, market cycles, and sector leadership to convey the same idea without repeating the primary label. This approach helps search engines connect concepts like market breadth, rate expectations, and investor psychology with your content, improving relevance for readers seeking how to interpret price movements.

Stock Market Trends: Reading Signals and How to Identify Market Trends

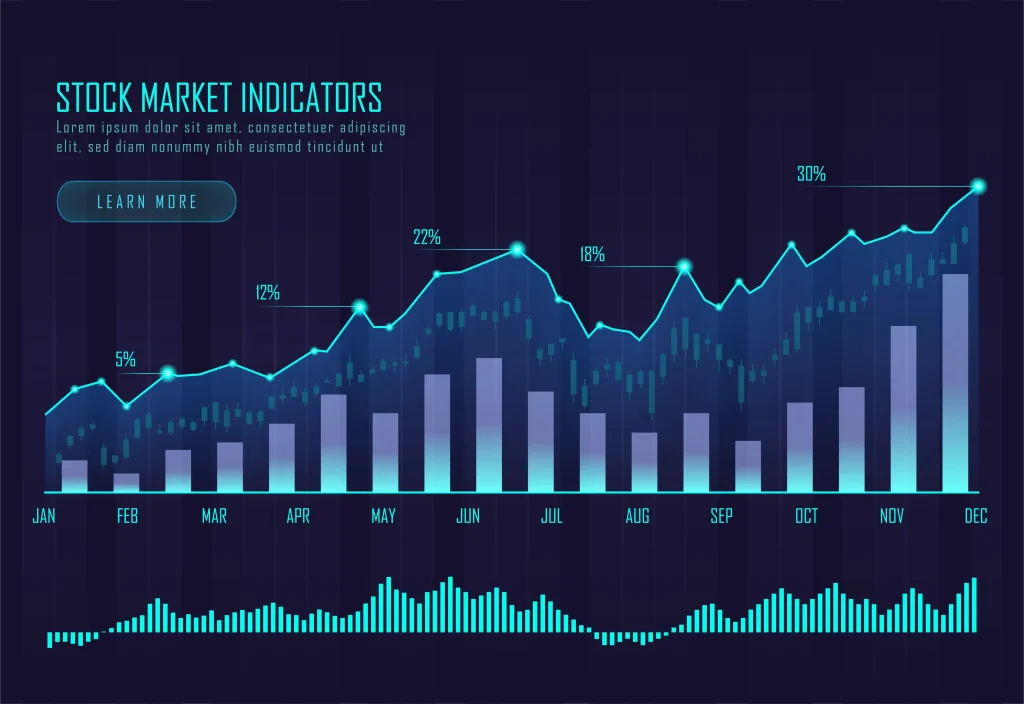

Stock Market Trends describe the directional rhythm of equities over time. By tracing price action, volume, and momentum across primary (long-term) and secondary (intermediate) horizons, you gain a framework for distinguishing meaningful movement from noise. When paired with stock market indicators and a disciplined market trend analysis, this view helps you position portfolios to participate in gains while managing risk. Whether you are evaluating current conditions or studying historical patterns, the core idea remains the same: trends emerge from collective behavior, not random ticks.

To read stock market trends today, you should combine price action with breadth, macro context, and robust indicators. A bullish primary trend is supported by higher highs, higher lows, and rising volume, while a sustained downturn shows lower highs, lower lows, and waning volume. If you want to know how to identify market trends, start with price action and confirm with breadth and macro context. Use a consistent process to examine multiple time frames, confirm signals with moving averages such as the 50-day and 200-day, and monitor momentum tools like RSI and MACD to gauge potential reversals. This integrated approach keeps you aligned with the trend rather than chasing noisy moves.

Market Trend Analysis for Investors: Investing Strategies for Stock Market Trends

Market Trend Analysis for Investors emphasizes turning signals into practical allocations. By watching sector leadership, breadth, and cycle dynamics, you can tailor investing strategies for stock market trends that aim to capture the strength of the move while limiting downside. Rely on stock market indicators to confirm breadth and momentum, ensuring the trend is broad and sustainable rather than driven by a few names. The analysis also considers macro context, including inflation, interest rates, and policy developments, so you can anticipate regime shifts before price action fully reflects them.

Implementing investing strategies for stock market trends means choosing a framework that fits your goals and risk tolerance. In a confirmed uptrend, consider overweighting equities or specific sectors while maintaining disciplined risk controls, such as position sizing and stops. Rotate into leaders as the market broadens, and hedge modestly when volatility rises to preserve upside. Regular reviews of how to identify market trends in your portfolio help you adjust exposure using scalable tools like ETFs or diversified index funds. Documenting decisions in an investment journal can improve your understanding of market trend analysis and support more consistent outcomes over time.

Frequently Asked Questions

What are the essential stock market indicators to use for market trend analysis and reading stock market trends today?

Key stock market indicators for market trend analysis include moving averages (50-day and 200-day), momentum metrics (RSI, MACD), market breadth (advancers vs. decliners, new highs vs. new lows), volume patterns, sector leadership, and macro context. To read stock market trends today, examine price action across daily, weekly, and monthly timeframes and confirm the trend with a rising 50-day above the 200-day (or a bullish cross), rising volume on up days, and broad breadth. Be mindful that volatility, sector rotation, or macro shifts can alter signals, so always integrate macro context into your market trend analysis.

What investing strategies for stock market trends work best when applying market trend analysis and stock market indicators?

Investing strategies for stock market trends that align with market trend analysis and key stock market indicators include: 1) trend-following allocations: overweight equities when the primary trend is up, with risk controls such as trailing stops; 2) sector rotation: shift exposure toward leadership groups as breadth broadens within the trend; 3) risk management and diversification: position sizing, stops, and cross-asset diversification to weather reversals; 4) dollar-cost averaging during pullbacks in a bullish trend; 5) tactical hedging in uncertain regimes using options or inverse instruments. These approaches rely on how to identify market trends: start with price action and moving averages to define the trend, confirm with momentum and breadth, and adjust exposures as leadership and macro context evolve.

| Key Point | Summary |

|---|---|

| Stock Market Trends form the backbone of investing decisions. | Help define the market tempo across long-, intermediate-, and short-term horizons to guide risk management and portfolio positioning. |

| Trend levels. | Primary (long-term), Secondary (intermediate), and Short-term (days–weeks) describe the market’s direction on different timeframes. |

| Interpreting trends with price action and volume. | Higher highs and higher lows with rising volume suggest an uptrend; lower highs and lower lows with waning volume signal a downtrend; combine with momentum and macro context for fuller view. |

| Primary trend characteristics. | Lasts months to years and defines the overall market environment: bullish, bearish, or sideways. |

| Secondary trend characteristics. | Unfolds weeks to months and often corrects the primary trend with pullbacks or rallies within the larger direction. |

| Short-term trend characteristics. | Spans days to weeks and offers entry opportunities but carries higher noise. |

| Key indicators to monitor. | Moving Averages (50-day and 200-day) with crossovers (golden cross / death cross); Momentum (RSI, MACD); Market Breadth; Volume/Price action; Sector Leadership & Rotation; Economic/Policy Context. |

| Reading trends today (practical steps). | Identify the dominant trend across timeframes; confirm with momentum; assess breadth; look for price-volume clues; consider macro context. |

| Practical investment approaches. | Trend-following allocations; Sector rotation; Risk management; Dollar-cost averaging during pullbacks; Tactical hedging. |

| Common mistakes to avoid. | Treating temporary bounces as new trends; overreliance on a single indicator; neglecting risk controls; failing to adapt to regime shifts. |

| Case examples and real-world context. | Illustrates how trends interact with rate cycles, breadth, and macro data in practice. |

Summary

Stock Market Trends shape how investors interpret price action, momentum, breadth, and macro signals, guiding portfolio construction and risk management. This descriptive overview emphasizes that trends emerge from collective behavior, are observable through price swings and volume, and are influenced by earnings, policy, and global events. By identifying primary, secondary, and short-term trends, monitoring key indicators, and applying disciplined strategies, investors can participate in gains while managing downside risk. The goal is to stay aligned with the market’s trajectory, adapt to changing regimes, and use trend analysis to inform smarter decisions across market cycles.