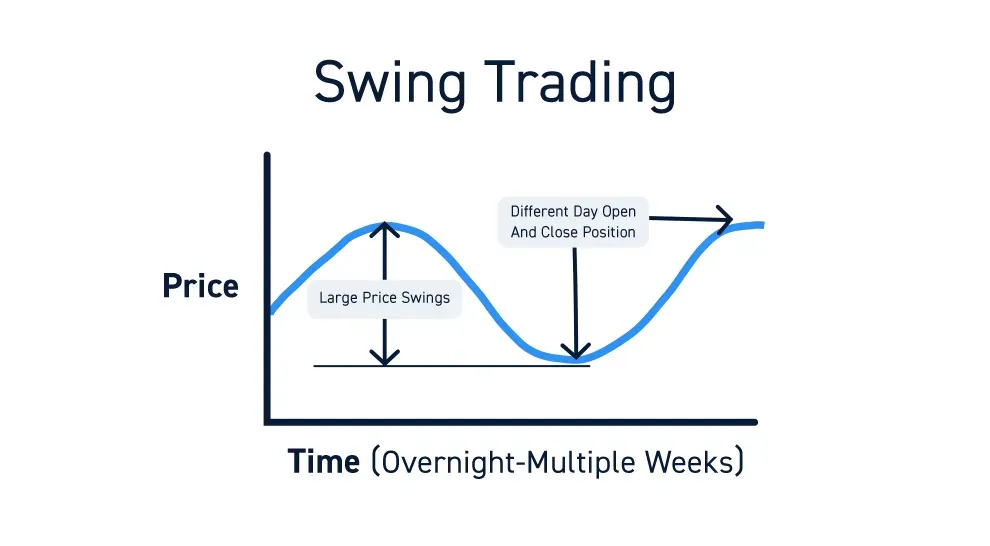

Stock Market Swing Trading offers a practical framework for capturing price moves in liquid stocks, aligning with proven swing trading strategies while avoiding the intensity of day trading or the commitment of long-term investing, and it emphasizes disciplined setup selection, liquidity awareness, and clear risk controls. This approach targets shorter time horizons—often a few days to a couple of weeks—while balancing the potential for meaningful short-term gains with disciplined risk controls, trade localization, and predefined stop-loss rules that help manage emotional decision making. If you’re seeking a structured path to capitalize on momentum, pullbacks, and breakout opportunities, this guide provides actionable tactics, additional drills for practice, and essential risk management for swing traders, all delivered within a repeatable workflow you can implement in real time. A core principle is to identify setups that tend to unfold over several sessions, using technical analysis for swing trading to confirm entry points and defined exit rules, supported by trend, volume, and pattern confirmations that reduce guesswork. By combining liquidity screening, prudent position sizing, and a disciplined exit plan, you can pursue short-term gains while targeting quality opportunities, including the best stocks for swing trading, in a framework that balances upside with controlled risk and ongoing learning.

In other words, this approach sits between day trading and longer-term investing, emphasizing intermediate timeframes and momentum-driven moves in liquid equities. Think of it as momentum trading on a shorter horizon, focusing on price-action clues, chart patterns, and confirmed breakouts rather than overnight bets. This lens highlights near-term price swings, pullbacks to key moving averages, and selective exposure to stocks showing predictable reactions to catalysts. By framing strategies around activity, volatility, and disciplined risk controls, traders can build a resilient routine that aligns with both personal risk tolerance and market structure.

Stock Market Swing Trading: Strategies for Capturing Short-Term Gains

Stock Market Swing Trading offers a practical framework for capturing price moves in liquid stocks without the intensity of day trading or the commitment of long-term investing. This approach targets shorter time horizons—often a few days to a couple of weeks—while balancing the potential for meaningful gains with disciplined risk control. If you’re seeking a structured path to capitalizing on momentum, pullbacks, and breakout opportunities, this guide on Stock Market Swing Trading provides actionable strategies, essential risk management practices, and a clear workflow you can implement in real time.

Core swing trading strategies for short-term gains focus on capturing portions of a move rather than predicting every twist in a stock’s journey. Momentum-based breakouts look for stocks with rising volume that clear short-term resistance, signaling the onset of a new swing. Pullbacks to moving averages—such as a 20-day or 50-day line—offer higher-probability entries when price bounces off support. Chart-pattern breakouts from formations like flags, pennants, and cup-with-handle patterns often precede meaningful moves, especially when confirmed by volume expansion. In markets with range-bound behavior, mean-reversion opportunities can arise at established support or resistance levels, though these setups should be used sparingly and with careful risk controls. Event-driven catalysts, such as earnings volatility, can create short-term swings, but demand disciplined risk management and predefined exit targets to protect against adverse gaps.

When selecting targets for swing trades, liquidity matters. Favor stocks with reliable average daily volume, clear breakpoints, and patterns that translate into repeatable setups. The goal is to identify the best stocks for swing trading that can deliver consistent swings without excessive slippage. A disciplined approach also means avoiding overexposure to a single name and balancing positions across sectors to reduce idiosyncratic risk, all while maintaining a clear entry-and-exit framework that aligns with your risk tolerance.

Technical Analysis, Risk Management, and Stock Selection for Sustainable Swing Gains

Technical analysis forms the backbone of Stock Market Swing Trading, guiding you to recognize trends, momentum shifts, and defined risk points. Foundations include moving averages (such as the 20-day and 50-day) to identify the prevailing trend and potential pullback zones, along with momentum indicators like RSI and MACD to confirm the strength of a move. Price patterns and levels—support and resistance, flags, pennants, and cup-with-handle formations—provide actionable entry and exit signals when paired with volume confirmation. Because swing trades unfold over several sessions, volume and liquidity are crucial to reduce slippage and improve fill certainty on entries and exits.

Risk management and psychology sit at the core of sustainable swing trading. For swing traders, every setup should include a predefined stop loss and a realistic profit target to maintain a favorable risk-reward profile, typically 1:2 or better. Position sizing should reflect your overall capital and risk tolerance, ensuring that a single loss does not derail your plan. Beyond the mechanics, disciplined trading psychology—avoiding overtrading, resisting chasing moves, and sticking to a written plan—helps preserve edge over time. A trading journal amplifies learning from both wins and mistakes, reinforcing patterns that support short-term gains.

A practical workflow combines technical analysis with disciplined stock selection and a repeatable routine. Start each day with a scan for liquidity-rich names and patterns that meet your criteria, then analyze price action, volume, and momentum signals before entering. In stock selection, consider stocks with clear patterns and catalysts—bringing in the idea of the best stocks for swing trading—while maintaining diversification across sectors. Regularly review performance, refine entry and exit criteria, and stay aware of macro conditions that influence sector momentum to sustain consistent swing gains.

Frequently Asked Questions

How does Stock Market Swing Trading generate short-term gains using swing trading strategies, and how does technical analysis for swing trading support risk management for swing traders?

Stock Market Swing Trading aims to capture price moves over several sessions, offering short-term gains without the intensity of day trading. By using swing trading strategies that target momentum, pullbacks, and breakouts, traders participate in meaningful moves while maintaining disciplined risk control. Core elements include: momentum-based breakouts, pullbacks to moving averages (e.g., 20-day and 50-day), chart-pattern breakouts, and selective mean-reversion opportunities. Technical analysis for swing trading emphasizes trend and momentum indicators (moving averages, RSI, MACD) to confirm direction, volume and price patterns to define entry/exit points, and clear support/resistance levels to guide decisions. Risk management hinges on predefined stop losses, favorable risk-reward ratios (often at least 1:2), appropriate position sizing, and optional trailing stops. A practical daily workflow—scan, chart analysis, confirmed entries, and end-of-day review—helps maintain consistency for short-term gains.

What are the best stocks for swing trading, and how should I apply technical analysis for swing trading to identify reliable setups for short-term gains?

Best stocks for swing trading are highly liquid, with tight bid-ask spreads and solid average daily volume, providing the liquidity needed for multi-session moves. Look for volatility that produces meaningful swings without excessive risk and for clear catalysts or patterns such as earnings momentum or sector rotation. To apply technical analysis for swing trading and spot reliable setups: use trend and momentum tools (20/50-day moving averages, RSI, MACD) to confirm direction; identify price patterns and key levels (flags, pennants, cup-with-handle) and ensure there is clear support/resistance and volume confirmation. Enter near support or on a breakout with strong volume, set stops beyond logical points (swing lows or ATR-based), and target at defined resistance with potential trailing stops to capture extended gains. Maintain proper position sizing and diversification to manage risk while chasing short-term gains.

| Aspect | Key Points |

|---|---|

| What is Stock Market Swing Trading? | Between intraday trading and longer-term investing; targets short-term moves over several sessions; emphasizes momentum, pullbacks, and breakout opportunities; uses defined entry/exit rules and disciplined risk controls. |

| Time Horizon | A few days to a couple of weeks; less intensive than day trading; not as long-term as investing. |

| Core Strategies for Short-Term Gains |

|

| Technical Analysis Foundations |

|

| Stock selection for effective swing trades | Liquid, reasonably volatile stocks with clear catalysts or patterns. Screen for:

Diversification across sectors; never overweight a single position; tailor position sizing to risk tolerance. |

| Entry and exit rules for prudent short-term gains |

|

| Risk management & psychology | Risk controls are the backbone: adhere to limits, stops, and favorable risk-reward. Maintain psychological discipline: avoid overtrading, resist chasing moves, and keep a written trading plan and journal to learn from outcomes. |

| Practical workflow for a daily swing trading routine |

|

| Common pitfalls & how to avoid them |

|

| Tools, resources, & continuing education | Reliable charting tools, real-time data, and educational resources; build a toolkit for pattern recognition, price action, and risk calculators. Regularly review performance and stay updated on market structure and macro conditions. |

| Illustrative example trade | Suppose a highly liquid stock trades around 50–60 with resistance near 60 and a rising 20-day MA. The stock flags a bullish pennant with increasing volume and a bullish MACD crossover. Enter on a breakout above 60, stop at 58, target 66. If 66 is reached with momentum remaining, adjust stop to break-even or trail to lock profits. |

| Conclusion (table context) | N/A |

Summary

Stock Market Swing Trading emphasizes a practical framework to capture short-term moves in liquid stocks with disciplined risk control. It blends momentum, pullbacks, and breakouts, supported by clear entry/exit rules, sound position sizing, and a measured workflow. By focusing on liquidity, defined patterns, and consistent risk-reward practices, traders can pursue repeatable short-term gains while mitigating drawdowns. A structured routine, ongoing education, and disciplined psychology are essential for lasting success in stock market swing trading.