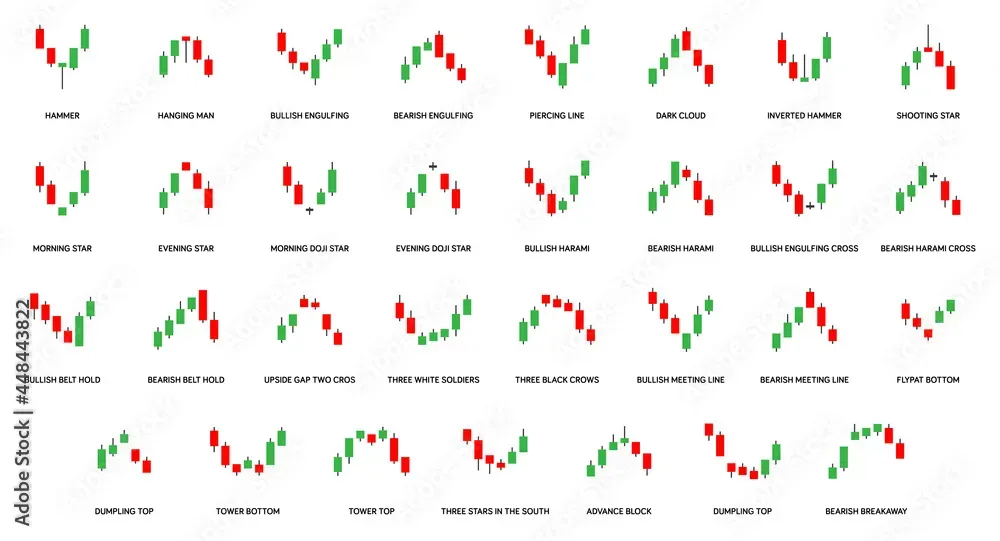

Stock Market Signals shape how traders interpret price action and guide smarter decisions in today’s volatile markets, acting as a central reference point that distills a torrent of data—from real-time quotes and macro news to earnings chatter and liquidity shifts—into a coherent view of where prices might go next, which is essential for anyone who wants to trade with discipline rather than react impulsively, and this clarity helps you set expectations, plan entries and exits, and measure performance over time. By reading stock charts, you translate raw price movements into visible patterns, and by watching volume indicators and applying technical analysis indicators, you assess the strength behind those moves, weigh the odds of different outcomes, and update your risk exposure accordingly rather than relying on gut feeling, and it also highlights the importance of context, such as sector trends and broader economic cycles. Understanding candlestick chart interpretation helps you read intraday sentiment with nuance—recognizing doji, hammer, engulfing patterns, and their context within prior trends—while moving averages and RSI provide a compass for trend direction and momentum, letting you gauge whether a rally has room to run or is running out of steam, and this perspective reduces overreaction to single candles by encouraging a broader view across timeframes. This descriptive guide demonstrates how to combine these signals into a practical framework, turning scattered observations into a coherent checklist that highlights high-probability setups, confirms them with volume, and filters out noise caused by whipsaws or misleading chart quirks, and this routine helps you stay patient and objective. A well-structured overview also links to techniques like chart-pattern recognition, risk controls, position sizing, and systematic review processes to turn signal insights into durable, web-ready strategies that readers can apply across markets and timeframes, and it promotes consistent decision-making and resilience in the face of changing conditions.

Alternative terms for this topic emphasize price action cues, liquidity signals, and momentum indicators that traders use to assess potential moves. By focusing on price behavior, traded volume, and the interactions between support, resistance, and moving averages, readers encounter a framework that remains robust across markets. Latent Semantic Indexing guides the use of closely related concepts such as trend strength, chart patterns, and risk-managed decision-making to reinforce the core ideas without overemphasizing any single term. In practical terms, the same principles come alive when you observe how buyers and sellers interact, how volume confirms or dampens moves, and how simple tools like moving averages and RSI fit into a larger analysis.

Stock Market Signals: Reading Stock Charts and Volume to Gauge Market Momentum

Stock Market Signals arise from the confluence of price action and traded volume. By studying price action on charts, traders gain insight into who is in control—buyers or sellers—and how sentiment shifts over time. Reading stock charts, especially candlestick chart interpretation, reveals intraday dynamics and potential turning points; patterns like breakouts or reversals hint at where the next move may go.

A disciplined approach to reading stock charts involves evaluating trendlines, chart patterns, and well-defined support and resistance levels. When price tests a support level and bounces, the signal is stronger if accompanied by rising volume—this is where volume indicators confirm conviction and help you separate noise from signal.

Technical Analysis Indicators in Practice: Moving Averages, RSI, and Candlestick Interpretation

Technical analysis indicators translate chart patterns into measurable signals, but they work best when used together. Moving averages smooth price data to reveal trend direction, while RSI gauges whether recent moves are overbought or oversold. A crossover between moving averages—such as a shorter-term average crossing above a longer-term one—can suggest a bullish shift, reinforcing the insights from candlestick chart interpretation.

Other tools like MACD add momentum context, and the way these indicators align with price action strengthens a trading plan. However, avoid overreliance on a single indicator. By considering moving averages and RSI alongside candlestick interpretation and MACD signals, you build a more robust framework for decision-making.

Frequently Asked Questions

What are stock market signals, and how can reading stock charts and volume indicators help you anticipate price moves?

Stock market signals come from price action, volume, and widely used technical analysis indicators. Reading stock charts reveals trends, breakouts, and key support/resistance levels, while volume indicators confirm the strength behind moves and help distinguish lasting moves from noise. To improve accuracy, combine this with indicators like moving averages and RSI to gauge trend direction and momentum, using multiple confirmations rather than a single signal.

How should you use candlestick chart interpretation with moving averages and RSI to confirm stock market signals?

Candlestick chart interpretation provides insight into intraday sentiment and potential reversals. Strengthen signals by reviewing candlestick patterns in the context of trend lines and key levels, then confirm with moving averages (e.g., crossovers) and RSI readings. For example, a bullish candlestick near rising support with price above a rising moving average and RSI climbing from oversold can indicate a higher-probability setup, whereas misalignment between these elements should prompt patience and further confirmation.

| Aspect | Key Points | Practical Takeaway |

|---|---|---|

| Stock Market Signals: What they are |

|

|

| Reading stock charts |

|

|

| Volume and price |

|

|

| Moving averages |

|

|

| RSI |

|

|

| MACD |

|

|

| Candlestick patterns |

|

|

| Practical signal integration |

|

|

| Risk management |

|

|

| Education and ongoing learning |

|

|

Summary

Stock Market Signals emerge from the interplay of price action, traded volume, and a handful of widely used technical analysis indicators. Reading stock charts, evaluating volume indicators, and applying moving averages, RSI, and other indicators can illuminate market direction and help you make more informed decisions. However, signals are not guarantees; they are most effective when confirmed across multiple timeframes and paired with robust risk management and capital allocation. A disciplined framework that integrates chart reading, volume analysis, risk controls, and continuous learning helps investors navigate uncertainty with greater confidence. By staying curious and backtesting strategies, you can adapt Stock Market Signals to changing market regimes and improve long-term outcomes.