Stock Market Bubbles refer to dramatic episodes where asset prices surge well beyond fundamentals, fueled by speculation, crowd psychology, and easy liquidity. Understanding these episodes helps both traders chasing quick profits and long-term investors seeking to protect wealth. By studying the signs—often labeled as bubble indicators—you can spot overheating markets earlier. The analysis emphasizes practical approaches to protect capital during volatility. The discussion also links valuation concepts to broader economic patterns, highlighting portfolio diversification as a prudent shield.

In other terms, these episodes resemble asset-price booms that detach from fundamentals, fueled by exuberance and abundant liquidity. Analysts describe them as market overheating, speculative rallies, or irrational optimism that pushes prices beyond credible valuation metrics. By analyzing historical cycles, investors can recognize common patterns—rapid price acceleration, widening credit, and crowd-driven momentum—before a correction. This framing supports prudent decision-making aligned with robust risk management and a long-run investment strategy.

Stock Market Bubbles: Navigating the Interplay of Economic Cycles and Valuation

Stock Market Bubbles emerge when favorable macro conditions—low interest rates, easy liquidity, and rising profits—drive prices beyond what fundamentals would justify. In this environment, economic cycles interact with investor psychology to push valuations into territories that look sustainable only in hindsight. Tracking bubble indicators such as extreme price-to-earnings, price-to-sales, and price-to-book ratios can reveal when markets have detached from underlying cash flows.

Beyond raw numbers, robust risk management and thoughtful portfolio diversification help protect long-term wealth. Diversifying across sectors, geographies, and asset classes reduces exposure to a single speculative theme, while disciplined position sizing, explicit drawdown limits, and systematic rebalancing anchor decisions in risk rather than emotion.

Detecting Bubble Indicators: From Valuation Metrics to Risk Management and Portfolio Diversification

Detecting bubble indicators requires combining macro signals with micro-level valuation metrics. When price action crowds attention, and margin debt or corporate leverage climbs, valuations can separate from fundamentals even as economic cycles remain supportive. A breadth check—whether many stocks participate in the rally or only a few—is another crucial bubble indicator that warns of fragility.

Implementing risk management and portfolio diversification strategies becomes critical as these signals intensify. Favor quality businesses with durable cash flows and conservative balance sheets, maintain cash reserves for opportunistic buying, and rebalance to maintain target risk exposure. This approach helps preserve capital and keeps the door open to long-run compounding when valuations normalize after the bubble deflates.

Frequently Asked Questions

What are the key bubble indicators and valuation metrics to watch for Stock Market Bubbles forming within current economic cycles?

Stock Market Bubbles often show a cluster of signals. Bubble indicators include valuations that are stretched relative to long-run norms across multiple metrics (valuation metrics such as price-to-earnings, price-to-sales, and price-to-book), profit margins that peak and then erode, and rising margin debt or corporate leverage fueled by easy liquidity. You may also see broader participation by new, speculative investors, narrowing market breadth, and macro signals like shifting rate expectations. Taken together within an economic cycle, these patterns suggest elevated risk of a sharp reversal. To act on these signals, rely on valuation-aware entry points, avoid chasing overextended rallies, and implement disciplined risk management and portfolio diversification to protect capital while staying invested for the long run.

How can risk management and portfolio diversification help protect wealth during Stock Market Bubbles across different economic cycles?

Risk management and portfolio diversification provide a guardrail during Stock Market Bubbles across economic cycles. Practical steps include: 1) define maximum acceptable drawdown per position and overall portfolio; 2) use prudent position sizing and stop-loss rules where appropriate; 3) diversify across asset classes (stocks, bonds, real assets) and geographies to reduce exposure to a single bubble-driven theme; 4) rebalance regularly to lock in gains and rebalance toward more favorable risk-adjusted opportunities; 5) maintain cash or liquid assets to seize opportunities or cushion drawdowns; 6) avoid excessive leverage and pursue valuation-aware entry points rather than chasing peaks; 7) maintain a written investment plan that governs risk, diversification, and exit rules. These practices help preserve capital, reduce drawdowns, and support long-term growth through different economic cycles.

| Aspect | Key Points |

|---|---|

| Definition |

|

| Why they matter |

|

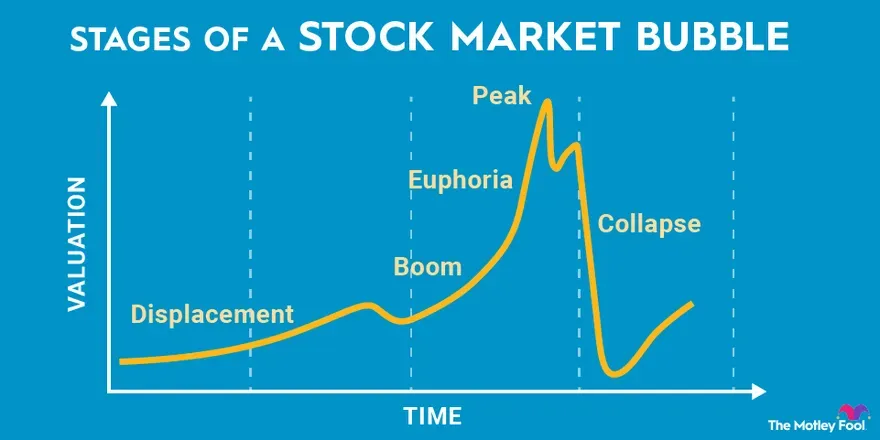

| Anatomy / Stages |

|

| Historical examples |

|

| Key indicators |

|

| Lessons from history |

|

| Practical strategies |

|

| Common mistakes to avoid |

|

| Putting it together today |

|

Summary

Stock Market Bubbles are a recurring feature of financial markets, shaped by psychology, liquidity, and evolving economic cycles. By studying past episodes, investors can recognize warning signals and avoid overexposure to overhyped sectors. The most reliable long-term approach blends prudent risk management with diversification, valuation-aware entry points, and a well-defined investment plan. With patience, discipline, and a focus on quality, you can navigate bubble dynamics more effectively and continue to grow wealth over time.