How to read stock market charts is a foundational skill that helps you understand price movements and make informed trading decisions. For beginners, the topic can feel overwhelming, but a practical approach to stock chart indicators and candlestick chart basics makes the path clearer. This concise guide walks you through stock chart patterns for beginners and the fundamentals of technical analysis basics so you can move from confusion to confidence. You’ll also learn how to interpret stock charts to assess momentum and risk. With a simple framework and a touch of practice, you can start applying what you learn to real trades.

Beyond the basics, think of price charts as a storyboard of price action where each bar or candle tells a part of the market’s story. LSI-friendly terms like price action, trend dynamics, support and resistance, and volume context help you connect the visuals to actionable ideas. You can broaden your toolkit by using graph-based indicators, momentum cues, and pattern recognition without overloading on any single metric. In practice, this approach aligns what you see on the screen with the broader method of technical analysis, ensuring your decisions are grounded in evidence rather than guesswork.

How to read stock market charts: A practical guide for beginners

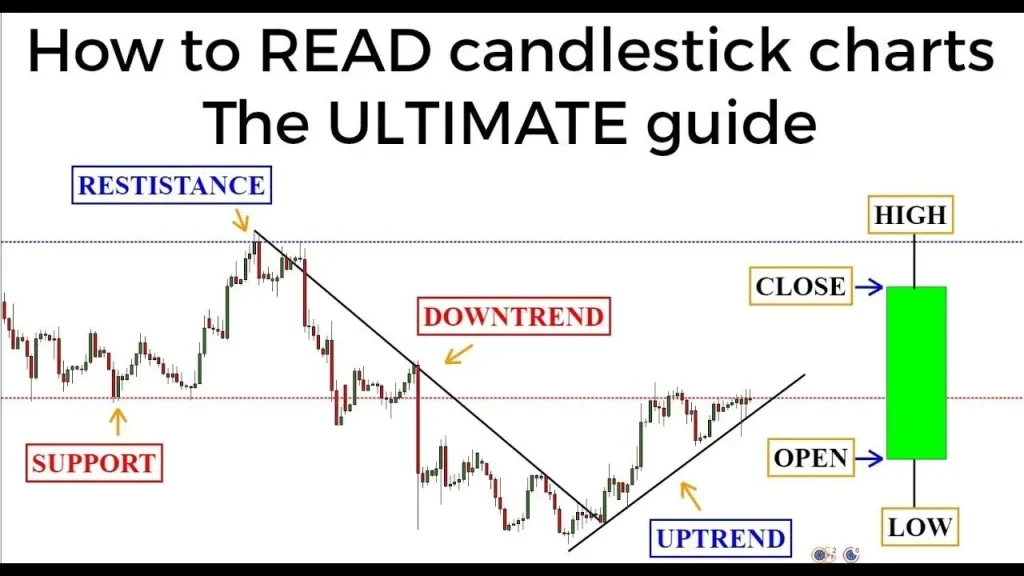

Reading stock market charts condenses hours of price data into a visual narrative. For beginners, start with candlestick chart basics to see opening, closing, high, and low for each period, and learn how price action reveals who’s in control—the buyers or the sellers. By watching how bodies and wicks form, you’ll begin to spot trends, momentum shifts, and potential reversals without being overwhelmed by a flood of indicators.

In practice, build a simple toolkit that makes the message of the chart easier to read. Use a short‑term moving average and RSI to support what you see in price action, and pay attention to volume as a confirmation signal. This approach aligns with technical analysis basics and shows how to interpret stock charts with widely used stock chart indicators.

Stock chart patterns for beginners: how to interpret stock charts and read indicators

Pattern recognition is a practical way to read momentum in price action. By focusing on common stock chart patterns for beginners—such as breakouts from a range and simple double bottoms—you learn where supply and demand are exerting pressure. When you couple these patterns with candlestick chart basics, you gain a clearer view of how patterns form and what they imply for likely moves.

To turn patterns into actionable ideas, validate them with volume and indicators. A breakout supported by rising volume increases the odds of continuation, while indicators like MACD or RSI can confirm momentum. This workflow reflects technical analysis basics and helps you learn how to interpret stock charts with confidence, using stock chart indicators as helpful confirmations.

Frequently Asked Questions

How to read stock market charts: what are the essential candlestick chart basics and indicators a beginner should know?

When learning how to read stock market charts, start with candlestick chart basics to understand price action. Each candle shows open, high, low, and close, revealing who controlled the session. Focus on price action and trend, and use volume to confirm moves. Keep indicators simple at first: a short- and long-term moving average to identify trend, and the RSI to gauge momentum. Remember that context from news or earnings strengthens interpretation, so use indicators to confirm—not replace—price action. This approach aligns with the fundamentals of technical analysis basics and helps you build a practical framework for reading charts.

How to interpret stock charts: a practical approach using stock chart patterns for beginners and technical analysis basics?

A practical path starts with a clear timeframe and a view of the trend (up, down, or range). Then read candlesticks for momentum signals, noting bodies and wicks that hint at strength or reversals. Check volume to confirm the validity of moves, and use 1–2 indicators as confirmations rather than sole triggers. Look for beginner-friendly stock chart patterns such as breakouts from a range, pullbacks within a trend, and simple reversals like double tops/bottoms. Finish with a simple plan: define entry, stop-loss, and take-profit rules. This workflow reflects technical analysis basics and leverages stock chart patterns for beginners to improve decision-making.

| Topic | Key Points |

|---|---|

| Purpose of stock market charts | Condense price data into a visual story; reveal price action, trends, momentum, and reversals; context from volume and news improves decisions. |

| What charts show and why it matters | Price on the vertical axis and time on the horizontal axis; volume and context (earnings, news) influence interpretation. |

| Types of charts you’ll encounter | Line, Bar, and Candlestick charts; each offers different levels of detail; candlesticks are the most popular for readability. |

| From line to candlestick: what beginners should focus on | Line shows general direction; candlesticks reveal price range, body size, and wicks to indicate momentum and potential reversals. |

| Key candlestick patterns for beginners | Doji; Hammer and Inverted Hammer; Engulfing; Morning Star and Evening Star; patterns signal momentum or reversals when used with context. |

| Understanding stock chart indicators (the basics) | Moving Averages; RSI; Volume; MACD; use 1–2 reliable indicators to confirm price action; avoid relying on a single indicator. |

| How to interpret stock charts: a practical step-by-step approach | Choose a time frame; identify trend; examine candlesticks; check volume; use indicators cautiously; confirm with multiple signals; define a plan. |

| Stock chart patterns for beginners that you can apply today | Breakouts from a range; pullbacks within trends; double bottom/top; trends and continuations; look for confirming signals. |

| Practical steps to start practicing reading stock market charts | Use a charting platform with a free trial; set up candlesticks, 20-day MA, and RSI; practice across stocks/time frames; maintain a simple checklist; journal trades. |

| Common mistakes beginners should avoid when learning to read stock charts | Overcomplicating setups; ignoring context; overreliance on one indicator; trying to predict every move. |

| Bringing it all together: a beginner-friendly mindset for stock chart reading | Adopt a simple, data-driven routine; validate ideas with data; iterate and stay disciplined in risk management. |

Summary

How to read stock market charts is a foundational skill that opens a clear window into price action, trends, and market psychology. By combining line, bar, and candlestick visuals with beginner-friendly indicators like moving averages, RSI, and volume, you create a practical framework for analyzing price action and validating trade ideas before you act. Start with a simple setup, observe the trend, read candlesticks for momentum and potential reversals, and confirm signals with context from volume and news. Practice consistently, keep a charting journal, and gradually expand your toolkit to improve decision-making and confidence in your stock market analyses.