Global Stock Markets are an expansive, interwoven system where events across regions ripple through portfolios, shaping economic sentiment and corporate decisions in ways that can emerge suddenly yet unfold over months. In 2025, investors weigh how global stock market trends 2025 interact with central bank policy impact as policy moves influence interest rates, liquidity, credit conditions, and the valuation of growth versus value stocks across developed and emerging markets. Understanding these dynamics helps explain why stock market correlations shift alongside inflation readings and growth signals, as investors reassess risk premia, funding conditions, and sector leadership in real time. Key economic indicators such as GDP momentum, wage growth, consumer spending, and productivity trends shape expectations for earnings, capital allocation, and the speed with which discount rates incorporate new information. This introductory overview highlights the interconnected forces shaping returns across equities, bonds, currencies, and commodities, guiding readers toward a practical framework for navigating risk, identifying opportunities, and aligning portfolios with evolving macro themes.

Beyond that label, the global equities panorama reveals an intricate web where worldwide markets tend to move in tandem under shared drivers—from policy signals to technological and demographic shifts. Explaining the topic through terms like international stock arenas, cross-border market linkages, and cross-asset dynamics helps readers understand how inflation, growth trajectories, and monetary stances steer outcomes. This LSI-informed framing emphasizes correlations across asset classes, liquidity conditions, and investor sentiment, illustrating how equity performance often echoes moves in bonds, currencies, and commodities. A descriptive, user-friendly approach keeps these ideas accessible while supporting SEO goals by using related terms and natural variations on the core concept.

Frequently Asked Questions

What are the key drivers behind Global Stock Markets in 2025, and how do global stock market trends 2025 shape investment decisions?

Global Stock Markets in 2025 are driven by central bank policy impact, evolving economic indicators, and stock market correlations across regions. Policy shifts affect discount rates and liquidity, while inflation and growth signals shape earnings expectations and sector leadership. In the global stock market trends 2025 landscape, investors should monitor GDP growth, inflation, and employment data alongside policy guidance, focusing on quality earnings and diversified exposures to navigate changing correlations.

How can investors use stock market correlations and economic indicators to navigate Global Stock Markets today?

In Global Stock Markets, tracking stock market correlations helps assess diversification benefits as policy surprises and macro data move assets together or apart. Economic indicators, such as GDP growth, inflation, unemployment, and manufacturing activity, signal the likely path of policy, rates, and valuations. A practical approach: monitor changing correlations between equities and bonds, adjust risk exposure ahead of central bank policy impact announcements, and tilt toward high-quality, cash-generative names when indicators point to resilient growth. Maintain hedges for currencies and rates to manage cross-border risk.

| Aspect | Key Points | Implications |

|---|---|---|

| Interconnectedness | Markets ripple across regions; inflation, growth, policy shape correlations across equities, bonds, currencies, and commodities. | Global diversification and cross-asset risk management are essential. |

| Macro Backdrop 2025 | Inflation cools in some regions; growth remains uneven; central banks recalibrate; real rates and fiscal policy matter. | Valuations and leadership depend on policy expectations and growth signals. |

| Sector Rotation & Correlations | Technology, defensives, and cyclicals rotate; correlations shift with policy surprises and ESG themes. | Observing cross-asset correlations aids timing and hedging. |

| Monetary & Fiscal Policy | Policy communication, balance sheet normalization, and coordination with fiscal policy matter; fiscal impulses can boost productivity or crowd out investment. | Market expectations drive valuations and risk premia. |

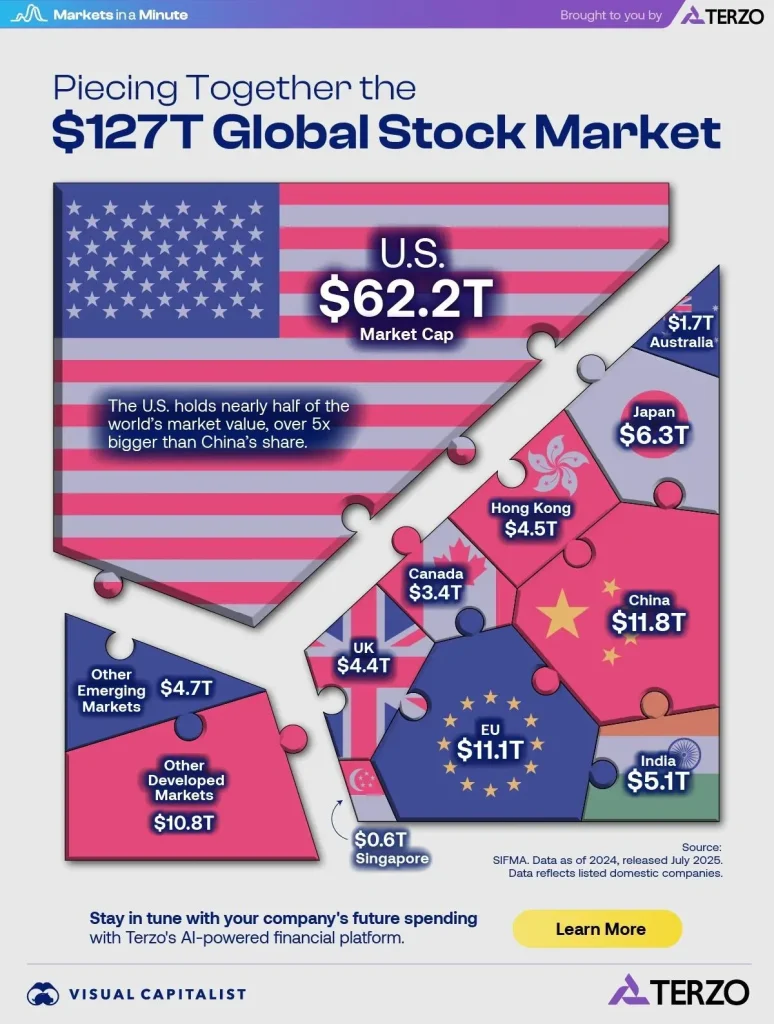

| Regional Variations | North America resilience; Europe energy constraints and regulation; Asia regulatory shifts; EM sensitivity to commodities. | Regional leadership shifts demand diversified strategies. |

| Commodities & Currencies | Commodity cycles signal demand; currency moves affect exporters and risk premia. | Cross-border risk management and hedging considerations become more important. |

| Investor Behavior | Sentiment, algorithmic trading, risk parity, and passive flows influence moves. | Diversification and strong fundamentals help resilience. |

| Risk Management | Diversification plus scenario analysis; monitor liquidity, leverage, concentration; stress tests across regimes. | Preparedness mitigates losses during shocks. |

| Investment Implications | Flexible asset allocation; focus on quality cash flow; thematic exposures; hedging; monitor central bank communications. | Dynamic positioning preserves upside and controls drawdowns. |