Fintech and Technology Trends are redefining the financial landscape, reshaping how capital moves, how risk is managed, and how everyday customers interact with a widening array of services that blend convenience, transparency, and choice, and catalyze collaboration across incumbents and startups alike. These shifts are powered by faster payments, smarter analytics, and API-driven ecosystems that fuse software innovation with traditional banking practices, unlocking efficiencies across merchants, lenders, and fintechs while creating new channels for engagement, loyalty, and competitive differentiation across new markets and channels. As these forces converge, digital payments become core to commerce, enabling near-instant settlements, omnichannel experiences, and frictionless checkout across devices, geographies, and network partners, while demanding tighter governance and scalable security to protect data and funds, including cross-border reconciliation. AI in fintech is enhancing fraud detection, underwriting, and personalized guidance, while open banking expands data access and collaboration through standardized APIs, enabling smarter budgeting, tailored offers, and proactive risk management that benefits both consumers and institutions, and amplifying the value of data-driven decision-making. Blockchain in finance and broader payments innovation continue to test new rails and governance models, demanding robust security, privacy protections, and compliant innovations as the landscape evolves toward faster settlement, transparent audit trails, and programmable money within trusted ecosystems, while accelerating interoperability across the financial ecosystem overall.

In other terms, this momentum is often described as the digital finance evolution, where technology-driven services reshape how value is stored, transferred, and protected. A modern, cloud-based ecosystem built on open APIs and partner networks enables neobanks, retailers, and incumbents to collaborate and co-create new capabilities. Beyond traditional categories, distributed ledger concepts, AI-powered risk analytics, and programmable payments illustrate the same trend from multiple angles, emphasizing governance, privacy, and customer-centric design. The result is a more accessible, interoperable financial system that prioritizes user-centric experience, transparent governance, and robust data privacy while regulators provide guardrails to ensure trustworthy innovation.

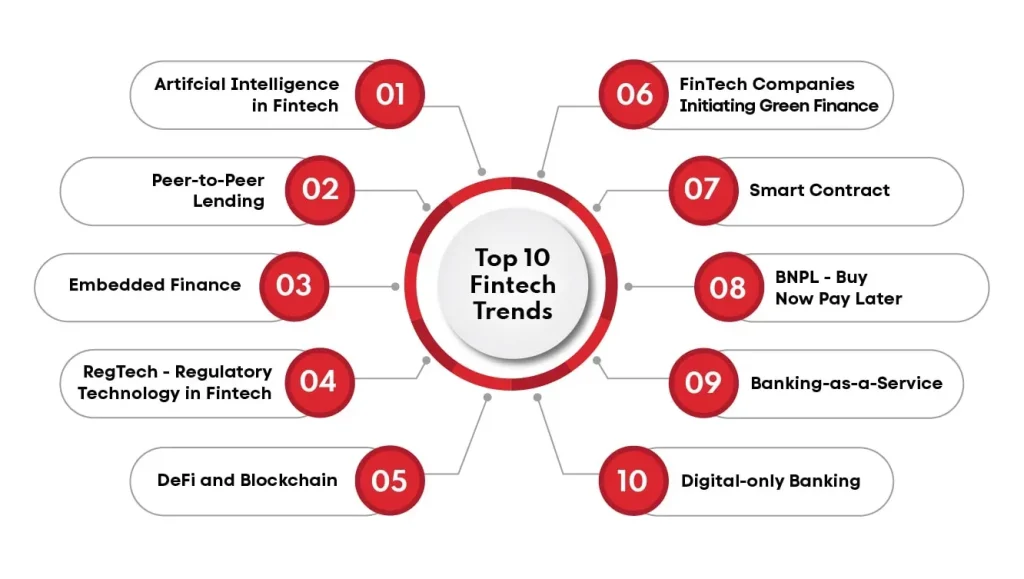

Fintech and Technology Trends: Digital Payments, AI in Fintech, Open Banking, and Blockchain in Finance

Fintech and Technology Trends are not distant forecasts but a living, evolving force reshaping how money moves, risks are managed, and customers interact with financial services. Central to this shift are digital payments, mobile wallets, and real-time settlement that empower merchants and banks to deliver seamless, omnichannel experiences. The convergence is reinforced by smarter analytics, API-driven ecosystems, and secure identity verification, enabling faster, more reliable transactions while keeping pace with regulatory expectations.

Alongside these changes, the industry is accelerating payments innovation through open banking, AI-enabled insights, and blockchain in finance. Interoperable APIs and cross-border payment capabilities unlock new partner ecosystems, while the emphasis on security and privacy ensures that rapid deployment does not compromise trust. This environment makes digital payments a core capability, driving more inclusive and efficient financial experiences for consumers and businesses alike.

Continued Innovation in Digital Payments, AI in Fintech, and Blockchain-Driven Settlements

As the landscape evolves, AI in fintech advances risk scoring, fraud detection, and adaptive authentication, enabling smarter credit decisions and personalized offers. By analyzing vast data sets, AI helps lenders balance growth with risk controls, supports Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, and reduces friction in onboarding and dispute resolution.

Blockchain in finance and distributed ledger tech further enhance settlement finality and auditability, especially in cross-border and trade finance contexts. When combined with open banking and API-enabled data access, blockchain accelerates transparent workflows, strengthens data integrity, and supports innovative payments solutions. Together, these trends underpin a resilient, secure, and customer-centric payments ecosystem.

Frequently Asked Questions

What fintech and technology trends are reshaping digital payments and AI in fintech?

Digital payments are accelerating through mobile wallets, QR payments, and real-time transfers, enabling seamless, omnichannel experiences. AI in fintech enhances risk assessment, fraud detection, and personalized offerings, while open banking APIs unlock secure data sharing and new services. Together, these trends drive faster settlements, smarter analytics, and customer-centric experiences, with ongoing payments innovation and regulatory considerations guiding safe adoption.

What role does blockchain in finance play alongside open banking and payments innovation in modern fintech?

Blockchain in finance enables faster, more transparent settlements and improved auditability for cross-border payments and trade finance. When combined with open banking and APIs, it supports secure data sharing, programmable payments, and new monetization opportunities. Organizations should weigh scalability, regulatory alignment, and robust identity and privacy controls to balance innovation with risk management.

| Topic | Key Points | Impact / Benefits |

|---|---|---|

| Digital Payments | Mobile wallets, QR payments, real-time transfers; omnichannel experiences; real-time settlement; interoperability; cross-border capabilities; lower costs; improved reconciliation; seamless checkout. | Drives faster, more convenient payments; reduces cash usage; sets customer expectations for seamless experiences. |

| AI in Fintech | AI/ML for smarter credit decisions, dynamic pricing, fraud prevention, enhanced customer service; risk scoring; alternative data; automation; supports KYC/AML processes. | Improved efficiency, better risk management, personalized offers, faster decisions. |

| Open Banking and APIs | Secure data sharing via standardized APIs; account aggregation; competition and innovation; monetization opportunities; governance and security. | Fuels new services, partnerships, and data-driven offerings; enhanced customer control over data. |

| Blockchain and Settlement Systems | Distributed ledger tech enables faster, more transparent settlements and cross-border payments; auditability; settlement finality; use cases in trade finance, remittances, supply chain finance. | Efficiency gains, greater resilience; not a universal replacement; enables new business models. |

| Payments Innovation | New settlement rails, instant payments, programmable money; near-instant cash flows; treasury management and liquidity planning; speed vs compliance and security. | Transforms cash flow management; enables new products/services; requires balancing speed with security and governance. |

| RegTech, Security, and Privacy | Identity verification, fraud detection, data privacy; robust cybersecurity; risk-based supervision; API security and incident response; third-party risk; consent frameworks. | Supports compliant growth and trust; reduces risk; protects customer data and privacy. |

| Customer-Centricity and Personalization | Data, analytics, and ML enable personalized experiences; tailored lending terms and payments; higher engagement and retention. | Improved customer satisfaction and loyalty; increased engagement and conversions. |

| Practical Implications for Businesses & Consumers | Operational efficiency; faster time-to-market; AI for pricing/credit; open APIs and partnerships; smoother payments; secure wallets; personalized products. | Competitive differentiation; better customer outcomes; scalable, resilient operations. |

| Challenges and Considerations | Interoperability and standards; security risks; regulatory variability; adoption and change management. | Need for adaptable standards, robust risk management, and governance to sustain innovation. |