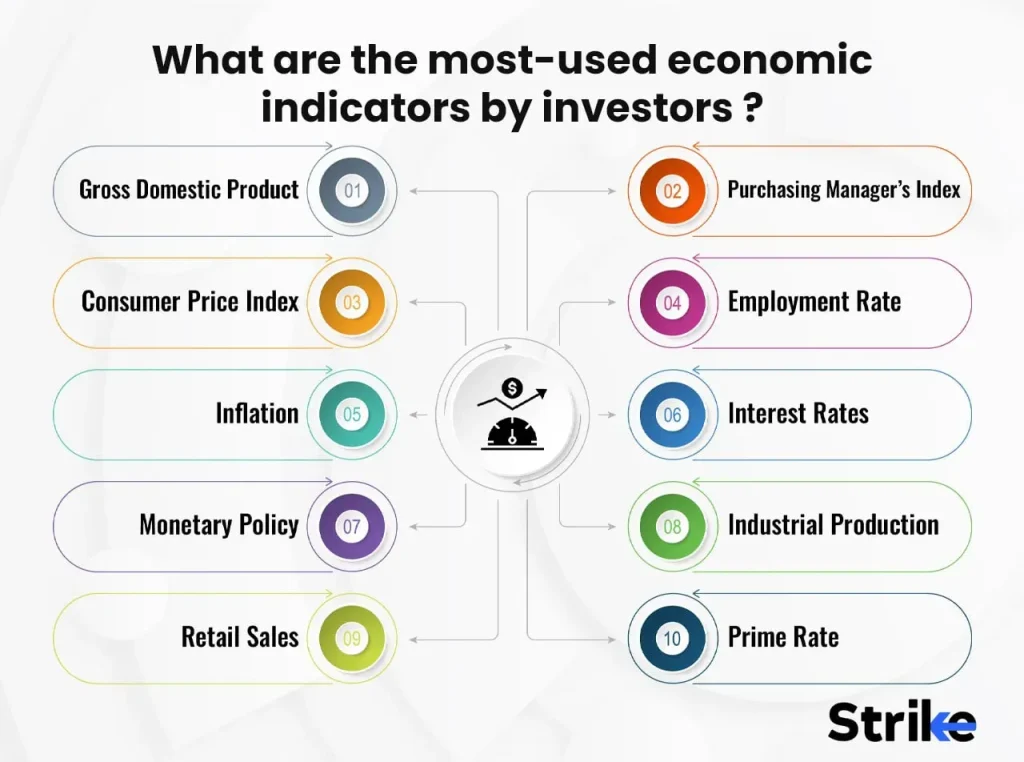

Economic indicators act as weather reports for financial markets, giving investors a clear sense of how stock market indicators, earnings, risk, and prices may move. GDP growth impact on stocks tends to surface when the economy accelerates, lifting corporate earnings and pushing valuations higher. The unemployment rate stock market link shows how strong hiring supports consumer demand and equity performance, while weak payroll data can weigh on prices. The inflation effect on stocks becomes clearer as rising prices push up yields and recalibrate discount rates across sectors. Finally, central bank policy and stock prices respond to these signals, reshaping expectations for rate moves and asset valuations.

Beyond the headline numbers, macroeconomic data provide a map of the forces shaping investor sentiment across asset classes. These indicators shed light on growth momentum, employment trends, and price dynamics, guiding analysts toward the broader market signals that influence equity valuations. By aligning this data with central bank expectations and the policy outlook, traders can anticipate potential shifts in risk appetite and sector leadership. In practice, the goal is to translate complex statistics into a coherent narrative about how markets may respond to changing economic conditions.

Economic indicators in the stock market: reading the signals

Economic indicators, from GDP estimates to unemployment figures, act as weather reports for the markets. They tell investors what the broad environment looks like and how earnings potential might unfold, influencing risk appetite and price levels. When traders talk about stock market indicators, they’re measuring how macro data translate into market moves. In this sense, GDP growth impact on stocks is central: rising GDP usually signals stronger demand, higher corporate profitability, and more confident investing, which tends to lift prices across cyclical sectors.

At the same time, inflation readings and employment data shape expectations for central bank policy and the discount rate used to value future cash flows. The inflation effect on stocks is most evident in how rate expectations compress or expand valuations, particularly for growth names with rich future cash flows. The unemployment rate stock market dynamic matters because a tight labor market can support household income but also raise wage pressures that squeeze margins. Investors watch for surprises and revisions because they can reset the narrative about earnings growth and sector leadership.

GDP growth, unemployment, inflation, and central bank policy: macro forces shaping stock prices

Putting macro indicators into context means mapping them to sectors and investment themes. When GDP growth accelerates and inflation shows signs of easing, investors may rotate toward cyclicals and tech beneficiaries of expansion, while watching central bank policy and stock prices for the exact timing of rate moves. In this lens, the GDP growth impact on stocks interacts with central bank policy, and the stock market indicators you monitor reflect those policy signals in near real time.

Practical use cases include building a dashboard that tracks leading indicators, a forecast of earnings momentum, and a risk framework that accounts for policy surprises. For example, if inflation remains elevated and the central bank hints at a tighter path, valuation multiples may compress across growth sectors, while value and defensive stocks may fare better. By layering indicators such as unemployment rate stock market and inflation effect on stocks with policy commentary, investors create a more robust, data-driven approach to stock selection and risk management.

Frequently Asked Questions

What is the GDP growth impact on stocks, and how do stock market indicators reflect this relationship?

GDP growth impact on stocks: When the economy expands, earnings prospects generally improve and stock prices rise, particularly for cyclical sectors. Slower GDP growth or contractions tend to weigh on earnings and valuations. Stock market indicators—leading, coincident, and lagging—help translate these macro signals into market expectations about earnings momentum and risk. Investors monitor GDP data and revisions alongside policy expectations to gauge how much future discount rates and risk appetite may change.

How do unemployment rate stock market trends and inflation effect on stocks interact with central bank policy to influence stock prices?

Unemployment rate stock market and inflation effect on stocks: A falling unemployment rate typically supports consumer spending and earnings, lifting stock prices, while rising unemployment can dampen demand and weigh on equities. Inflation affects stock valuations through expected policy rates: higher inflation can push central banks to tighten, raising discount rates and pressuring valuations, especially for growth stocks. Central bank policy and stock prices respond to these indicators: stronger data may prompt rate hikes or reduced asset purchases, while softer data can lead to looser policy and higher stock prices. Markets also react to surprises and revisions to the policy path, which can move sectors differently depending on rate sensitivity and pricing power.

| Aspect | Key Points |

|---|---|

| What are economic indicators and why they matter | Published statistics that gauge the health of an economy (GDP, unemployment, inflation, retail sales, manufacturing, consumer confidence). Indicators are often labeled leading, coincident, or lagging and together shape expectations for earnings, monetary policy, and risk in markets. |

| The big three: GDP growth | Rising GDP usually means higher demand, stronger earnings, and higher stock prices—especially for cyclical sectors. Slowing/negative GDP can depress earnings and valuations; quarterly prints and revisions inform growth outlooks. |

| The big three: unemployment rate | Labor market slack and income influence consumer spending. Falling unemployment supports confidence and demand; rising unemployment dampens spending and earnings. Markets also focus on momentum, not just the headline number. |

| The big three: inflation | Inflation affects real money value and rate expectations. High inflation tends to prompt tighter policy, higher discount rates, and compressed valuations, especially for growth stocks. Inflation surprises add volatility and sectoral winners/losers vary by pricing power. |

| Central bank policy and stock prices | Policy responses to indicators can move markets: stronger data may lead to rate hikes; softer data may lead to cuts. Forward guidance can shift expectations even before data are released. |

| Beyond the big three: other indicators | Consumer confidence, retail sales, PMIs, housing data, earnings guidance and margins, and financial conditions all influence expectations for growth, profitability, and risk appetite. |

| Data surprises and revisions | Markets react to surprises relative to expectations; revisions can reshape the narrative about the economy and policy path. |

| Practical interpretation for traders and investors | Context and consistency matter; monitor policy cues; avoid chasing every release; use a multi-indicator framework and align with your time horizon and risk management. |

| Historical context | Periods of strong growth with tame inflation or aggressive tightening show how indicators shape valuations and asset classes; policy signals often move markets alongside data. |

| Integrating indicators into a personal approach | Map indicators to sectors, pair macro with micro analysis, diversify across assets and regions, and maintain a disciplined process with ongoing learning. |

| Limitations and cautions | Indicators are imperfect; revisions, seasonality, and measurement errors occur. Markets may overreact or underreact; use indicators as part of a broader, risk-managed strategy. |

Summary

Key points table created. A descriptive conclusion follows that summarizes Economic indicators and market implications.