Top Stock Market Metrics you need to track, including stock market metrics to track, can guide smarter decisions by spotlighting the signals that actually move prices. There are many data points, but only a thoughtful subset will inform your choices, especially the key metrics for stock analysis that align with your goals, time horizon, and risk tolerance. This guide outlines the essential stock market metrics to track, explains how to interpret them, and shows how to weave them into a practical decision framework. By focusing on valuation, growth, momentum, risk, and liquidity, you turn information into insight and reduce the noise that often plagues investing performance indicators. Along the way, you’ll learn how to integrate these ideas into a dashboard metrics for trading decisions that stays readable and actionable, including financial metrics for portfolios.

This section revisits the topic using alternative terms and LSI-friendly phrasing to broaden relevance. Think of market indicators, performance gauges, and analytics for portfolios as different ways to describe the same core signals that informed investing choices. Other synonyms such as portfolio metrics, risk dashboards, and decision-support metrics help map these ideas to practical tools. By applying Latent Semantic Indexing principles, the content stays coherent for readers and search engines while illustrating how to apply the metrics in real-world trading.

Top Stock Market Metrics You Need to Track for Smarter Decisions

In a market that changes by the hour, the stock market metrics to track should be intentionally chosen to guide decisions rather than overwhelm you with data. Prioritize a compact, coherent set that covers price and valuation, growth and profitability, momentum, risk, and liquidity. When you filter out noise and map each metric to a decision you need to make, you transform raw quotes into actionable insights that support smarter allocation and timing.

Think of these metrics as part of the broader set of key metrics for stock analysis used to compare peers, assess growth trajectories, and judge earnings quality. Framing the data this way helps you connect price signals to fundamentals and to various investing performance indicators. When you translate these signals into a dashboard you can monitor, you enable near real-time adjustments to exposure and risk.

From Key Metrics for Stock Analysis to Dashboard Metrics for Trading Decisions

To operationalize these ideas, translate them into dashboard metrics for trading decisions. A well-designed dashboard surfaces valuation multiples, cash flow signals, margins, momentum triggers, and risk checks so you can see where price diverges from fundamentals at a glance. Viewing the data through the lens of investing performance indicators helps you gauge whether your stock selections are delivering the expected return given your risk budget.

Beyond single-stock analysis, these metrics feed into financial metrics for portfolios and guide asset allocation, hedging, and diversification. Pair traditional measures—ROE, ROIC, and free cash flow—with beta, Sharpe ratio, liquidity, and turnover to build a balanced view of risk-adjusted profitability. When aligned with a clear decision framework, your dashboard becomes a practical tool for executing ideas with discipline and reducing slippage.

Frequently Asked Questions

What are the top stock market metrics to track for smarter investing decisions?

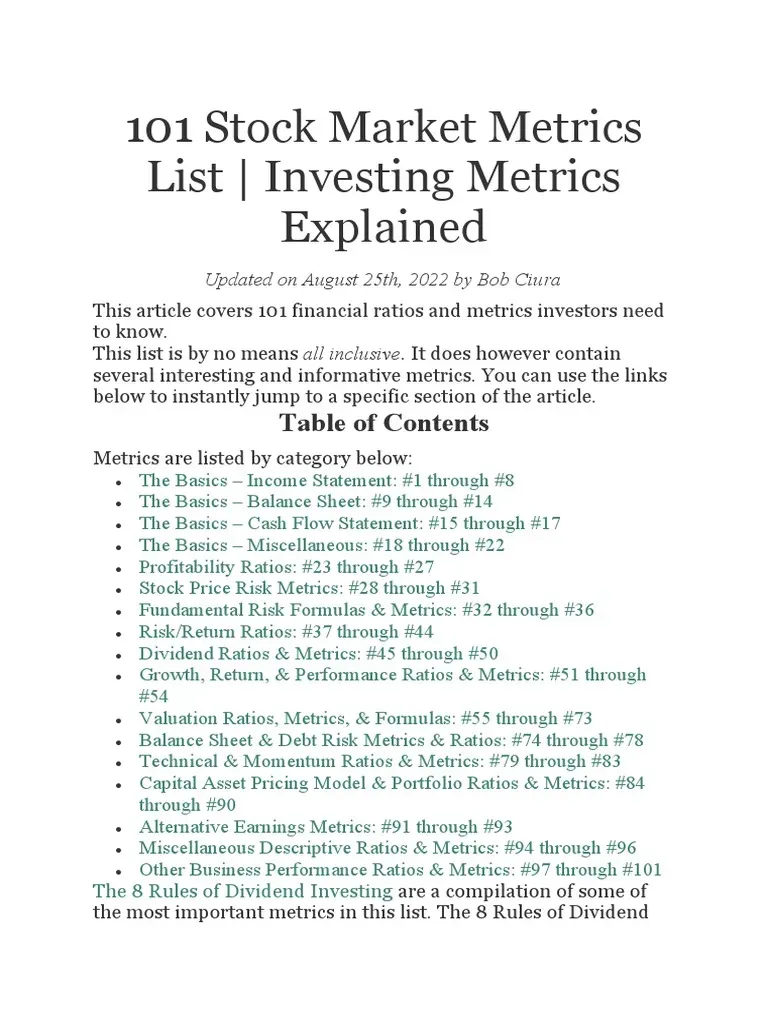

In the realm of Top Stock Market Metrics to Track for Smarter Decisions, focus on a concise set of indicators. Core price/valuation metrics like P/E, P/B, and P/S reveal how the market prices fundamentals. Growth metrics such as EPS growth and revenue growth, plus profitability measures like ROE and ROIC and margins, show whether a business can expand and sustain value. Include cash flow signals (free cash flow) to gauge earnings quality. Add momentum indicators (50-day and 200-day moving averages, RSI, MACD) to help timing, but only as a timing aid. Finally, assess risk and liquidity with beta, standard deviation, Sharpe ratio, and liquidity metrics to ensure alignment with your risk tolerance. Use these in a dashboard metrics for trading decisions to monitor peers, trend strength, and risk across your portfolio.

Which investing performance indicators should I monitor to evaluate stock analysis and portfolio results?

To measure investing performance, combine core valuation, growth, momentum, and risk metrics with portfolio-level indicators. Track valuation signals (P/E, P/B, P/S) alongside growth (EPS and revenue growth) and profitability (ROE, ROIC, margins) to judge quality. Monitor momentum and timing signals (moving averages, RSI, MACD) to confirm entries. At the portfolio level, use diversification, beta, Sharpe ratio, liquidity, and turnover to assess risk-adjusted returns. These financial metrics for portfolios help you see each holding’s contribution to overall results and guide decisions aligned with your time horizon and risk tolerance.

| Metric category | Representative metrics | What it tells you / How to use |

|---|---|---|

| Price and valuation metrics | P/E, P/B, P/S; Dividend yield and payout stability | Assess whether price reasonably reflects fundamentals; compare across peers/history; consider growth expectations and risk; avoid chasing low numbers blindly. |

| Growth and profitability metrics | EPS growth, Revenue growth; ROE; ROIC; Profit margins; Free cash flow | Indicate durable growth and efficiency; gauge scalability and capital allocation; margins and free cash flow support earnings quality. |

| Momentum and technical indicators | Moving averages (50-day, 200-day); RSI; MACD; Price action patterns | Assist timing decisions; confirm fundamentals; avoid relying solely on momentum signals; use as a supplementary layer. |

| Risk, volatility, and liquidity | Beta; Correlation; Standard deviation; Sharpe ratio; Liquidity/Turnover | Balance upside with downside risk; liquidity affects execution and market impact; helps assess risk-reward of ideas. |

Summary

Top Stock Market Metrics guide smarter investing by highlighting the essential indicators that inform risk, growth, and portfolio outcomes. This descriptive overview shows how valuation, growth, momentum, and risk fit together to shape your decisions. By monitoring key measures such as price-to-earnings, price-to-book, price-to-sales alongside earnings growth, ROE/ROIC, and free cash flow, investors gain context for whether a stock’s price reasonably reflects its fundamentals. Momentum tools like moving averages, RSI, and MACD add timing signals while accounting for fundamental trends, and risk metrics such as beta, standard deviation, and liquidity clarify potential downside and execution considerations. The result is a practical dashboard that reduces noise, aligns data with your goals and risk tolerance, and supports more confident, disciplined investing.