How to Read the Stock Market is a practical compass that helps you interpret price action, manage risk, and make deliberate investment decisions. For beginners, read stock market for beginners feels approachable when explained through core ideas like stock market basics for beginners 2025 and a simple roadmap. You’ll discover how to read stock charts, build a routine, and apply stock market analysis for beginners to separate signals from noise. This guide also introduces the beginner’s toolkit for investing, emphasizing patience, practice, and a disciplined approach that works across markets. By focusing on fundamentals rather than hype, you’ll gain confidence as you observe price movement and learn a repeatable framework you can reuse daily.

In other terms, building market literacy means interpreting price action, earnings signals, and macro drivers as parts of a connected system rather than chasing isolated ticks. This view pairs chart-based reasoning with risk controls and fundamentals, helping you see how a move in one area often reflects broader price dynamics and sector rotation. By using related terms and connecting ideas, you follow an LSI-friendly path that makes topics like price trends, moving averages, and earnings impact feel part of a single learning framework. Ultimately, the goal is to cultivate a disciplined routine that balances curiosity with risk management, so your learning translates into consistent behavior across markets. Practically, you can start by a daily 5-minute skim of price action, then log what you notice about direction, volume, and momentum to reinforce learning. As you grow more comfortable, expand to weekly reviews that compare how your expectations matched actual outcomes, reinforcing the link between chart signals and real results. Over time, you’ll notice that disciplines such as risk budgeting, position sizing, and consistent review become just as important as the charts themselves. Remember, the aim is consistent progress rather than perfect foresight.

How to Read the Stock Market in 2025: A Practical Guide for Beginners

Reading the stock market starts with solid fundamentals and a clear view of price action. If you’re asking how to read stock market for beginners, begin with the basics and a simple framework that emphasizes consistency over hype. In 2025, the goal is to grasp core concepts like price movement, volume, and the way earnings and macro factors shape direction, without drowning in every indicator. This approach aligns with stock market basics for beginners 2025 and helps you build confidence as you learn to interpret what moves prices day to day.

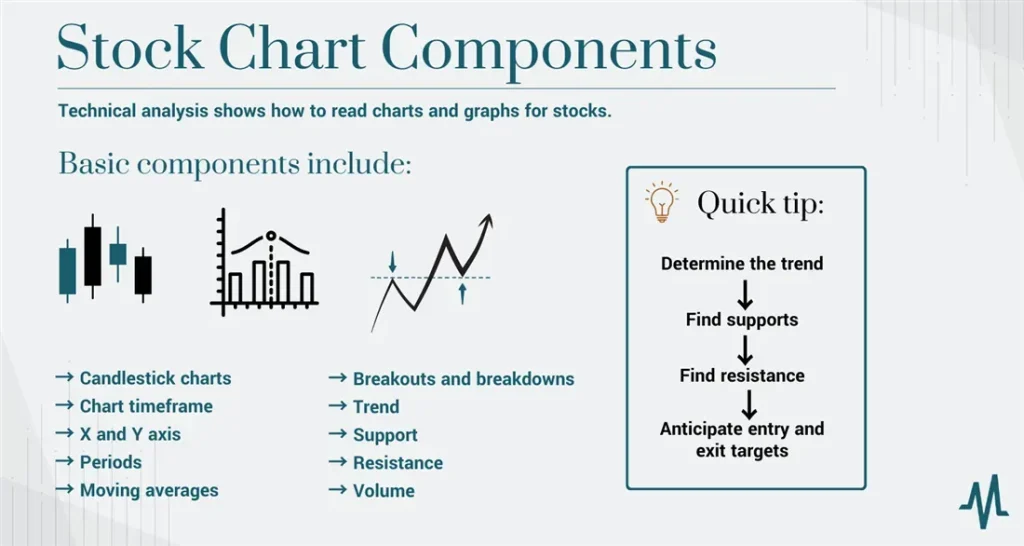

A practical way to start is by focusing on how to read stock charts and what those charts are telling you about momentum. Learn the essentials of line, bar, and candlestick charts, and pay attention to key signals such as price direction, volume changes, and the interaction of price with simple references like trendlines, moving averages, and levels of support and resistance. Remember, patterns aren’t guarantees, but they offer context that can improve your stock market analysis for beginners when combined with price action and fundamentals.

To turn insights into action, use your beginner’s toolkit for investing to establish a repeatable routine. Define goals, set risk limits, and keep your learning disciplined by tracking decisions and outcomes. This aligns with the broader idea of stock market analysis for beginners, where you balance technical signals with fundamentals to form a coherent view of whether a stock deserves attention, while avoiding overreaction to noise.

Stock Market Analysis for Beginners: Building a Consistent Routine

Moving from charts to concrete decisions requires a routine that embodies the stock market basics for beginners 2025 and reinforces steady progress. This section helps you translate observations into a practical process, so you can read market signals with confidence and reduce the impact of headlines. By integrating elements of the beginner’s toolkit for investing, you’ll learn to evaluate opportunities without overexposure to risk, and you’ll develop a framework that scales with your learning.

A sustainable routine might look like a weekly cadence that combines market breadth, earnings context, and personal risk checks. For example, start your week by scanning major indices and sector leadership, then review your watchlist and any new fundamentals that could justify adjustments. End the week with a concise recap of price action and a plan for the next steps. As you practice read stock market for beginners in real time, you’ll deepen your understanding of stock market analysis for beginners, reinforce your ability to read stock charts, and gradually rely more on a well-structured beginner’s toolkit for investing rather than impulse reactions.

Frequently Asked Questions

How to Read the Stock Market: What is the simplest beginner-friendly framework to start reading stock charts and learning stock market basics for beginners 2025?

Start with the basics: focus on stock market basics for beginners 2025 to understand what drives price moves. Use How to Read the Stock Market as a practical framework, beginning with how to read stock charts to observe trends, volume, and momentum. Keep your approach simple by anchoring decisions to a few core concepts (trend, support/resistance, risk) and a repeatable routine. Track outcomes in a journal to build confidence and discipline over time.

How to Read the Stock Market: How can the beginner’s toolkit for investing and stock market analysis for beginners help a new investor learn how to read stock charts and build a practical routine?

Leverage the beginner’s toolkit for investing to set goals, define risk, and apply a simple investing plan such as dollar-cost averaging. Pair this with stock market analysis for beginners and how to read stock charts to spot trends, validate signals with fundamentals, and avoid noise. Establish a monthly routine: review charts, update your watchlist, assess positions, and document what you learn to improve steadily. This approach translates How to Read the Stock Market into repeatable, disciplined actions.

| Aspect | Key Points | Why It Matters | Practical Takeaway |

|---|---|---|---|

| Foundation and Objective | Learning stock market basics, reducing surprises, and building confidence with a beginner-friendly toolkit for 2025. | Sets a baseline for interpreting price action across markets and helps you stay focused on fundamentals. | Start with fundamentals, focus on foundations over hype, and align learning with personal goals. |

| Core Concepts: Price Movement & Risk | Prices reflect value; key risk concepts; a repeatable analytical framework. | Understanding how price, risk, and context interact improves decision quality. | Use a simple, consistent framework to interpret moves and assess risk. |

| Reading Stock Charts | Familiarity with chart types (line, bar, candlestick); observe trend, volume, moving averages, support/resistance. | Charts reveal trends and momentum; they are the primary visual tool for beginners. | Start by observing a stock over weeks; note how price action and volume interact. |

| Indicators & Analysis | Moving averages, RSI, earnings/fundamentals, market breadth as signals; avoid over-reliance on a single metric. | Indicators add context but should complement price action and fundamentals. | Combine signals with fundamentals; test a simple, balanced approach. |

| Beginner’s Toolkit for Investing | Goals & risk tolerance, dollar-cost averaging, buy-and-hold, diversified watchlists, basic screening, risk management, journaling. | Provides actionable steps and repeatable habits aligned with risk limits. | Define goals, start simple, diversify, screen for fundamentals, and document decisions. |

| Applying the Framework: Routine | Weekly/monthly routines: market scan, watchlist review, news checks, and weekly action decisions. | A routine translates knowledge into consistent practice and helps tracking progress. | Create a routine (e.g., Monday scan, Tue-Thu review, Friday recap) and record outcomes. |

| Common Pitfalls | Overtrading, chasing tips, overreliance on one indicator, neglecting risk management, skipping learning/journaling. | Identifies typical traps to avoid cost and confusion. | Maintain discipline, use a watchlist, implement risk controls, and journal learning. |

| Tools & Resources | Reliable news outlets, company filings, free charting platforms, books, courses to support ongoing learning. | Supports continuous improvement and practical application of concepts. | Rely on reputable sources and build a personal kit of materials and datasets. |

| Outcome & Focus | Readers gain confidence and competence with a durable framework for evaluating price action. | A repeatable, comfortable process for navigating markets rather than chasing headlines. | Develop a disciplined, patient approach that adapts to 2025 and beyond. |

Summary

How to Read the Stock Market is a practical journey into price action, risk management, and disciplined decision-making that beginners can use to build confidence. This description emphasizes foundational knowledge, how to read stock charts, and a simple beginner’s toolkit for investing in 2025. By focusing on repeatable processes rather than trying to predict every move, readers learn to interpret price movement, assess risk, and act in alignment with long-term goals. The framework presented in How to Read the Stock Market encourages patience, consistency, and ongoing learning, helping you develop a durable skill set that remains relevant through 2025 and beyond.