Stock Market vs Economy raises an important question: how closely are financial markets tied to the broader economy, and what does that mean for returns? In practice, investors often treat the market as a barometer of economic health, yet the link is nuanced, forward-looking, and not simply one-directional, because expectations about policy, liquidity, and sector mix can override current data. Markets price in expected growth, profits, and policy shifts, while the economy reflects current conditions like output, jobs, and inflation; a practical lens is the relationship captured by economic indicators and stock market data, and it helps explain how investors discount future cash flows today. This interplay matters because stock benchmarks react not only to what already happened but to what many believe will unfold, including productivity gains, consumer demand, investment cycles, credit conditions, and the pace of monetary normalization. By keeping an eye on macro signals while scrutinizing earnings quality, balance sheets, and cash flow resiliency, readers can form a practical framework that accounts for cycles, risk tolerance, and the sometimes divergent paths between price levels and the real economy.

In the second paragraph, the discussion shifts to alternative terminology that mirrors the same core idea through a web-friendly, Latent Semantic Indexing approach. Think of the stock market as a sea of equity pricing, where prices reflect investor sentiment about future profits rather than current activity, and view the broader economy as the real-world backdrop that shapes demand, employment, and policy. Many readers will recognize how macro indicators, market signals, and business cycles interact, even when the headline numbers diverge month to month. To illuminate the topic without repeating exact phrases, this section uses related terms such as macro conditions, earnings stability, cash-flow quality, and sector composition to describe how financial markets respond to the dynamics of growth, inflation, and liquidity. The goal is to provide a coherent picture of how asset prices incorporate expectations about the macro environment while remaining anchored in company fundamentals and prudent risk management.

Stock Market vs Economy: Decoding the Relationship and Cycles

The Stock Market vs Economy relationship is best understood as a relationship between expectations and reality. The economy measures what is produced, consumed, and invested in a given period—essentially a record of what happened—while the stock market prices in future profits, productivity gains, and policy effects. Because investors discount future cash flows, stock prices often move ahead of the economic data, reflecting anticipated shifts in growth and profitability across economy cycles. This forward-looking lens helps explain why stock market returns can diverge from current GDP readings even when the larger trend remains connected to macro momentum.

Key to this connection are the core signals that markets monitor: GDP growth, employment and wage dynamics, inflation and real interest rates, and corporate earnings. The relationship between stock market and economy becomes clearer when considering how these indicators influence valuations and expected profits. Monetary and fiscal policy, as well as leading indicators like ISM readings and consumer sentiment, shape liquidity, risk appetite, and the trajectory of earnings, thereby linking stock market performance with broader macro conditions over time.

Continuing the Link: Why Returns and Economic Signals Diverge (and What That Means for Investors)

Divergences between stock market returns and the economy are common and instructive. Valuation, rather than current activity alone, drives prices as investors discount cash flows far into the future. This means stock market returns and economy cycles can show strength even when current output or employment data lag behind expectations, and vice versa. Financial conditions, sector dynamics, and structural shifts can further decouple short-term market moves from the latest macro prints, underscoring the importance of distinguishing between what the economy is doing now and what investors expect it to do next.

From a practical standpoint, recognizing the nuanced relationship between the economy and stock prices guides better decision-making. Focus on earnings quality and balance sheets, monitor how monetary and fiscal policy may alter discount rates, and align portfolio exposure with the cycle—cyclicals versus defensives—while keeping a long-term perspective in mind. By understanding how GDP, inflation, unemployment, and policy shape stock returns, investors can interpret market signals more accurately and position themselves to weather transitions across economy cycles.

Economic Indicators, Earnings, and Market Signals: Linking GDP, Returns, and Policy

Economic indicators and stock market analysis together form a framework for interpreting how the economy affects stock returns. Tracking GDP growth, employment trends, and inflation helps illuminate potential earnings trajectories and valuation shifts. When the data point toward expanding activity, earnings prospects tend to improve, supporting higher stock prices and a healthier relation between GDP and stock market performance over the cycle.

Leading indicators—confidence measures, ISM surveys, and capex plans—provide early clues about future momentum that markets incorporate ahead of official releases. This is where the stock market returns and economy cycles become most visible: asset prices reflect expectations for the next several quarters, not just the current quarter. By integrating economic indicators with earnings and policy expectations, investors can form a more durable view of how the economy will shape stock performance over time.

How to Use Indicators to Align Investments with Economic Phases

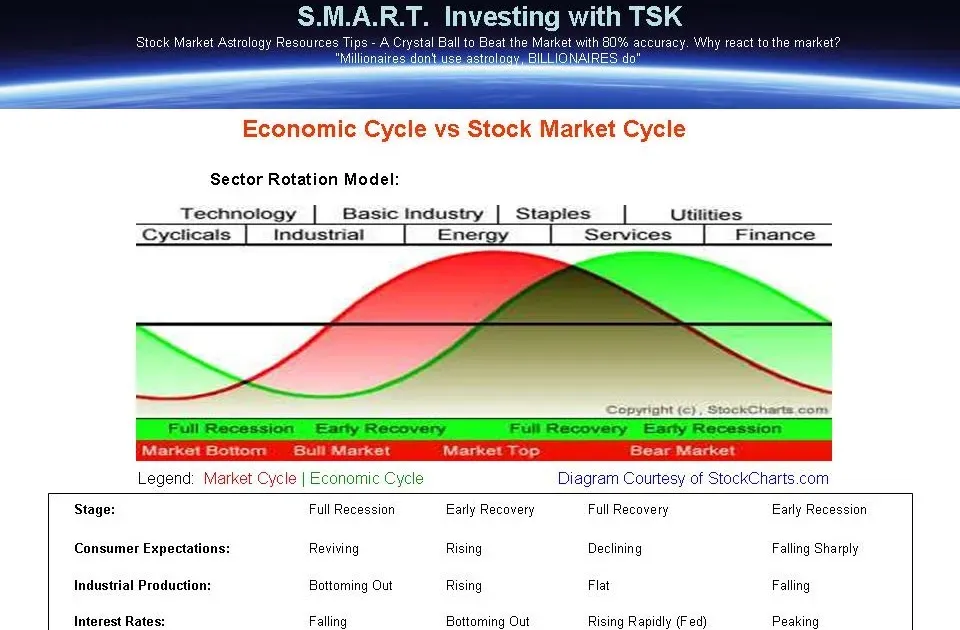

A practical lens is to view the economy through the prism of the relationship between stock market and economy and to position portfolios accordingly. In early-cycle phases, GDP-driven earnings growth can push equities higher as multiples expand on improving cash flows, while in late-cycle periods, valuations may face pressure from higher rates or slowing growth—an interplay that underlines the concept of stock market returns and economy cycles.

To stay resilient, emphasize cash flow durability and balance sheet strength, diversify across sectors to capture both cyclical and non-cyclical drivers, and maintain a long-term perspective that accounts for macro shifts. By focusing on how the economy affects stock returns—through earnings, valuations, and policy channels—investors can navigate transitions with a disciplined framework that respects the nuanced link between macro health and market performance.

Frequently Asked Questions

What is the relationship between the stock market and the economy, and how does the Stock Market vs Economy dynamic influence returns across cycles?

The relationship between the stock market and the economy is not a simple one-to-one link. The economy measures current output and conditions, while the stock market prices in expected future profits, policy changes, and growth. As a result, the market can lead, lag, or move independently in the short term, though earnings trends and macro momentum typically align over longer horizons. Investors should watch GDP growth, unemployment, inflation, and policy expectations, along with corporate earnings and balance sheets, to gauge likely stock performance. In practice, treat stock prices as a reflection of forward-looking fundamentals rather than a direct snapshot of current economic health.

Which economic indicators connect GDP and stock market performance, and how does the economy affect stock returns in practice?

Key indicators link GDP and stock market performance, including GDP growth, unemployment, inflation, and real interest rates. Inflation and rate trends influence discount rates and valuation multiples, while policy actions—monetary and fiscal—shape liquidity and risk appetite. Investors should monitor these indicators alongside earnings growth and balance-sheet strength to form a view on likely returns and sector leadership. The economy affects stock returns through earnings power and valuations, but market prices also reflect expectations and liquidity, so a disciplined, regime-aware approach helps navigate different cycles.

| Theme | Key Points |

|---|---|

| Relationship overview | The stock market is forward-looking and can lead, lag, or move independently from the current economy. Over the long run, a link tends to emerge through earnings and macro conditions. |

| Indicators that matter | Key economic gauges shape stock performance: GDP growth; employment and wage trends; inflation and real interest rates; corporate earnings; monetary and fiscal policy; and leading indicators and sentiment signals (e.g., ISM, confidence, capex plans). |

| Divergences between markets and the economy | Valuation of future cash flows, liquidity conditions, sector dynamics, and structural shifts can cause stock returns to diverge from real-time economic activity. |

| Earnings and multiples | Earnings growth translates into higher prices; valuation multiples expand or contract with interest rates, liquidity, and growth optimism, linking earnings to stock prices but not deterministically to current economy size. |

| Practical implications for investors |

|

| Market regimes |

|

Summary

The Stock Market vs Economy topic is introduced and clarified through the table above. The key points show that markets price in future profitability and policy impacts, not just current economic activity, and that earnings and valuations serve as the bridge between macro conditions and stock returns. Investors should use a disciplined framework—watch core indicators, stay diversified, and align portfolios with different economic regimes—to interpret market signals without equating stock prices with the economy.