Stock Market Psychology sits at the intersection of finance and human behavior, shaping how traders and long-term investors alike interpret risk, opportunity, volatility, and the insights of investor psychology.

By exploring how emotions influence decisions in moments of uncertainty, this field reveals why emotional investing can both undermine and enhance portfolio outcomes, especially when markets swing between doubt and optimism.

From a behavioral finance perspective, crowd psychology and individual biases explain why markets overreact, while disciplined strategies aim to counteract cognitive biases in investing through checklists, pre-commitment, and risk controls.

Recognizing market sentiment—the collective mood that colors interpretation of news and earnings—helps investors avoid chasing headlines and instead align with a long-term plan that accounts for crowd dynamics and time horizons.

This awareness helps investors diagnose personal tendencies, improve risk management, and build strategies that harmonize human nature with sound investing fundamentals, fostering resilience during drawdowns and patience during growth.

Beyond a strict label, the topic can be framed as market psychology and the study of investor behavior under uncertainty. LSI-friendly terms pair behavioral insights with emotional drivers, cognitive heuristics, and sentiment signals to map how prices move beyond fundamentals. Think of market sentiment, investor psychology, and cognitive biases in investing as interconnected signals that help explain why fear or greed can propel trends. By explaining these relationships with context from behavioral finance and neuroscience, readers gain a richer view of risk tolerance, timing, and disciplined decision making.

Stock Market Psychology and Emotional Investing: Leveraging Behavioral Finance for Better Outcomes

Stock Market Psychology sits at the intersection of finance and human behavior. Emotions such as fear, greed, and curiosity often steer decisions in ways that numbers alone cannot explain. This is where the study of Stock Market Psychology becomes practical: recognizing how emotional investing shapes risk tolerance and timing helps explain why markets overreact to news and why investors cling to losing positions too long. By framing these reactions through behavioral finance, you can translate feelings into measurable patterns that inform better strategy.

Applying behavioral finance principles creates a disciplined approach to counteracting cognitive biases in investing. Techniques like pre-commitment and rules-based investing set guardrails that reduce impulsive moves, while regular journaling and performance reviews reveal recurring biases and decision flaws. Diversification and a thoughtfully constructed asset mix help smooth volatility, allowing long-term plans to survive the inevitable swings driven by market sentiment rather than fundamentals alone.

Market Sentiment, Investor Psychology, and Cognitive Biases in Investing: From Bias Awareness to Portfolio Discipline

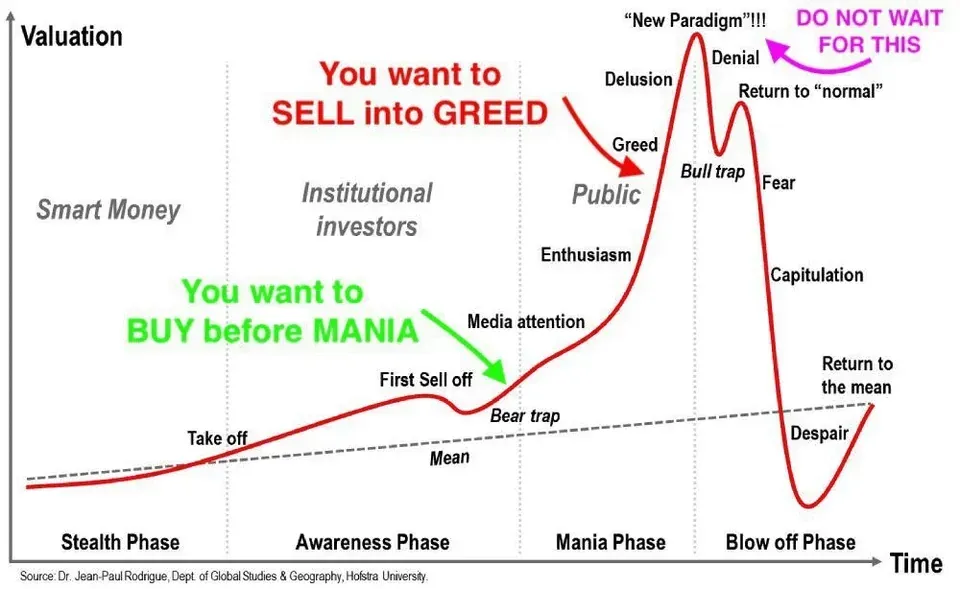

Market sentiment captures the mood of the market and often drives price action beyond what earnings or valuations would suggest. Positive sentiment can push stocks higher even when fundamentals are modest, while negative sentiment can depress prices despite solid prospects. Investor psychology explains why crowds can create momentum, and why a shift in sentiment can turn into a self-fulfilling cycle that magnifies pullbacks or rallies.

To translate these insights into practice, establish a disciplined framework: diversify across assets, rebalance at set intervals, and use pre-defined entry and exit rules. Maintain a decision journal to surface cognitive biases in investing and to track how sentiment influenced past choices. In parallel, deepen your understanding of emotional investing and behavioral finance, so you can recognize when market mood is steering you away from your plan and steer back toward objective criteria.

Frequently Asked Questions

What is Stock Market Psychology and how does emotional investing influence investment decisions?

Stock Market Psychology studies how emotions and cognitive processes drive investing behavior. Emotional investing—fear during drawdowns, greed after rallies, and anxiety during volatility—can lead to premature selling, chasing trends, or ignoring fundamentals. Behavioral finance explains these patterns as biases and heuristics that distort risk assessment. To mitigate these effects, focus on: • Recognizing common cognitive biases in investing (loss aversion, overconfidence, confirmation bias, recency bias). • Implementing rules-based investing and pre-commitments to reduce impulsive trades. • Diversifying and maintaining a long-term horizon. • Journaling and post-trade reviews to identify biases and improve future decisions. • Following structured decision frameworks and robust risk controls.

How does market sentiment influence investing within Stock Market Psychology, and how can investors manage cognitive biases in investing?

Market sentiment reflects the overall mood of investors and can drive prices beyond fundamentals, a key theme in Stock Market Psychology. Positive sentiment can fuel uptrends, while negative sentiment can magnify downturns. To manage cognitive biases in investing and improve decision quality, apply behavioral-finance–driven practices: • Pre-commitment and rules-based investing to reduce emotion-driven trades. • Diversification and proper asset allocation to dampen sentiment swings. • Dollar-cost averaging and a long-term horizon to smooth timing biases. • Journaling and post-trade reviews to surface biases like loss aversion and recency bias. • Use of checklists and decision frameworks to ensure risk, liquidity, and costs are considered. • Ongoing education about cognitive biases in investing to strengthen investor psychology.

| Key Point | Summary | Why it matters |

|---|---|---|

| Introduction to Stock Market Psychology | Stock Market Psychology studies how emotions and cognition influence decisions in volatile markets. | It helps investors recognize biases and improve long-term outcomes. |

| Emotions Matter in Investing | Emotions like fear, greed, and anxiety shape decisions; anticipating these effects supports better planning. | Understanding emotional drivers helps design strategies that counteract bias. |

| Behavioral Finance vs Traditional Finance | Behavioral finance explains deviations from rationality; it complements traditional finance. | Provides tools to interpret moves through a human lens, not just math. |

| Common Cognitive Biases in Investing | Biases include loss aversion, overconfidence, confirmation bias, recency bias, framing effects. | Recognizing biases is essential to avoid costly mistakes. |

| Market Sentiment | Market mood can drive trends and magnify moves beyond fundamentals. | Sentiment signals help explain why prices diverge from intrinsic value. |

| Investor Psychology in Portfolio Construction | Psychology affects risk tolerance, allocation, and review cadence. | Aligns portfolio with disciplined methods to weather emotion-driven trades. |

| Strategies to Manage Emotions | Pre-commitment, diversification, dollar-cost averaging, journaling, checklists, risk tools, and education. | Structured processes reduce impulsive decisions. |

| Behavioral Finance in Action | Real-world cycles show fear and greed affecting prices; interpretation helps learning. | Helps investors navigate cycles and improve resilience. |

| Practical Keys to Leveraging Stock Market Psychology | Plan, process focus, objective feedback, safe routine, and long-term perspective. | Guides sound decision-making and consistent results. |

Summary

Stock Market Psychology reveals how emotions and cognitive biases influence investing behavior, shaping risk choices, timing, and portfolio outcomes. By applying behavioral finance insights and implementing disciplined processes, investors can improve decision quality and resilience amid volatility. This approach helps turn psychological factors into a strategic advantage rather than a pitfall. The goal is to stay focused on long-term objectives, maintain discipline during drawdowns, and build processes that align actions with plans.