Read stock market charts is a practical skill that can transform how you approach investing. Whether you are a complete beginner or someone who has dabbled with prices and indicators, mastering stock chart reading basics helps you understand price action, identify opportunities, and manage risk. This practical guide blends candlestick chart patterns with core concepts of technical analysis for beginners, turning raw price data into actionable insights. By focusing on interpreting market trends and recognizing key support and resistance levels, you’ll gain a clearer view of how markets move and why prices change direction. If you commit to a simple, repeatable routine, you’ll build confidence and discipline as you practice reading price action over time.

Other terms for this practice include price-action analysis, visual chart interpretation, and chart-pattern recognition that help you follow a price narrative rather than relying on numbers alone. Think of it as market-data visualization and trend-context thinking, where patterns, lines, and momentum cues guide decisions for beginners. For newcomers, starting with straightforward chart interpretation—watching how price moves with volume and simple formations—is a practical, low-friction entry into technical decision-making. Emphasizing fundamental concepts like trend direction and consolidation offers a robust, beginner-friendly path to mastering market literacy. By adopting these LSI-aligned terms, you reinforce understanding while improving how your content resonates with search engines.

Read stock market charts: A practical guide to stock chart reading basics and candlestick patterns

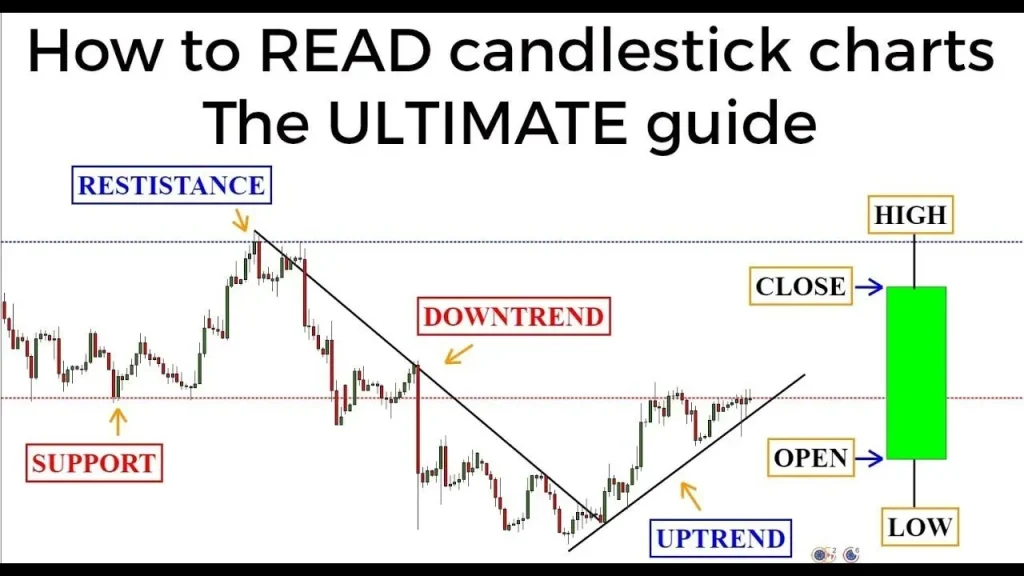

Reading stock market charts translates price action into a visual language that you can interpret. Focusing on stock chart reading basics helps beginners understand how candles encode open, high, low, and close, and how candlestick chart patterns like hammer, doji, and engulfing indicate shifting control between buyers and sellers.

Begin with a lean toolkit: price data, timeframes, moving averages, and a few overlays. In the context of technical analysis for beginners, concentrate on learning to read price action across multiple timeframes and to recognize when a simple setup aligns with higher-probability outcomes.

Interpreting market trends and levels: master support and resistance with technical analysis for beginners

Interpreting market trends starts with identifying the direction of price movement: uptrends, downtrends, or range-bound markets. By observing higher highs and higher lows, or lower highs and lower lows, you gain a framework for interpreting market trends that you can verify with trendlines and moving averages.

Support and resistance levels provide concrete decision points. When price repeatedly tests a floor or ceiling, those levels help you assess breakouts, pullbacks, and risk management. Pair these levels with volume considerations to filter false signals and apply practical, beginner-friendly technical analysis for beginners.

Frequently Asked Questions

How can I Read stock market charts to interpret market trends and identify support and resistance levels as a beginner?

To Read stock market charts effectively, start with the stock chart reading basics: study price action, candles, and timeframes. Look for the overall trend using higher highs and higher lows, and confirm with common tools like moving averages (e.g., 50-day and 200-day). Mark key support and resistance levels where price historically reverses or stalls. Seek confluence by aligning trend direction, price action near levels, and momentum signals such as RSI. Apply disciplined risk management: define risk per trade, set stops, and avoid overtrading. Regular practice with a journal will improve your ability to interpret market trends and plan entries and exits with clarity.

Which candlestick chart patterns should I focus on when Read stock market charts to learn technical analysis for beginners?

When Read stock market charts, focus on a lean set of candlestick chart patterns: hammer, doji, bullish and bearish engulfing, and shooting star. Use these signals when they appear near trendlines or at support/resistance levels, and seek confirmation with volume. Keep the toolkit simple by pairing candlestick patterns with moving averages (such as the 50-day and 200-day) and a basic RSI read for momentum. Avoid over-interpreting a single candle; look for multiple confirming signals and practice on daily or weekly timeframes to build reliability. Document patterns you observe to reinforce learning from stock chart reading basics.

| Key Topic | What to Know |

|---|---|

| Price data and candles | Candlesticks show open, high, low, and close for each interval. Bullish vs. bearish candles indicate who controlled the period. Key patterns include hammer, doji, and engulfing candles. |

| Timeframes | Charts cover from one-minute to monthly bars. Short timeframes reveal intraday volatility and entry/exit opportunities; longer timeframes reveal broader trends and major levels. Interpreting patterns across multiple timeframes is a practical skill. |

| Volume | Volume adds context to price moves. Breakouts with high volume are generally more reliable and help avoid false signals. |

| Patterns and lines | Trendlines, moving averages, and overlays summarize price action. Recognizing patterns such as cup-and-handle, head-and-shoulders, and pennants can help anticipate continuations or reversals, but require context and risk controls to avoid overfitting. |

| Moving averages | Moving averages smooth price data to reveal the underlying trend. Common ones are 50-day and 200-day; crossovers or bounces can signal momentum shifts. |

| RSI | RSI gauges whether an asset is overbought or oversold and provides a quick read on momentum strength and potential reversals. A practical starting point for beginners. |

| Other momentum tools | MACD and stochastic indicators are popular, but beginners should first master moving averages and RSI to avoid indicator overload. |

| Interpreting trends and levels | Trends are defined by higher highs/higher lows (uptrend) or lower highs/lower lows (downtrend). Confirm trends with multiple signals (price action, trendlines, moving averages). Support and resistance indicate likely reversal or breakout points. |

| Practical step-by-step approach | 1) Define timeframe and goals (intraday, swing, or long-term). 2) Observe the longer-timeframe trend. 3) Check moving averages (e.g., 50-day, 200-day) for interactions. 4) Assess momentum with RSI. 5) Analyze candlestick patterns around key levels. 6) Identify support and resistance. 7) Look for confluence of signals. 8) Practice risk management with defined risk per trade and stop-losses. |

| Common mistakes to avoid | Over-reliance on a single indicator, pattern overfitting to recent data, neglecting market context (earnings, macro news). Always test ideas via backtesting or paper trading and consider slippage and liquidity. |

| Practical practice and learning habit | Embed chart reading into a regular routine: keep a journal of why a setup makes sense, signals that supported the idea, and risk steps taken. Over time, you’ll recognize recurring patterns and gain confidence in trend strength and reversals. |

| Real-world examples and exercises | Hypothetical uptrend on a daily chart: higher highs and higher lows, rising trendline, potential bounce at a moving average, healthy RSI range, and rising volume on breakouts. If resistance nears and a reversal candle appears with shrinking volume, prepare for caution. Applying the steps helps translate price behavior into a practical trading plan. |

| Maintaining clarity in analysis | Keep analysis simple. Focus on a minimal set of signals—price action relative to moving averages, RSI momentum, and key support/resistance levels—rather than chasing every indicator. A disciplined, clear framework improves consistency. |