Stock Market Volatility is a reality every investor faces today, shaping decisions as prices move and headlines flash, but it also offers clues about what deserves attention in your portfolio and how to prioritize goals in a changing environment, including shifts in sector leadership, new data releases, and shifting investor sentiment that creates both risk and opportunity. During these periods, learning how to protect investments and apply disciplined risk management helps you avoid emotional reactions and instead stay aligned with a well-considered plan, even when markets swing wildly, news cycles intensify, and liquidity tightens, while you reduce risk and improve resilience over market cycles, a disciplined approach that also helps you rebalance selectively and reduce the impact of volatility on your overall portfolio. Smart investors emphasize portfolio diversification across asset classes and geographies, and they maintain an emergency fund to cover unforeseen expenses without forcing sales during sharp downturns, creating a buffer that supports patience and selective action, leveraging lessons from history and diversification strategies across regions. Understanding what drives fluctuations—from earnings surprises and policy shifts to geopolitical events and liquidity changes—helps you interpret volatility as information rather than chaos, enabling smarter trade-offs and steadier long-term growth, and by maintaining a disciplined savings habit that compounds over time, you can translate volatility into resilience across multiple market cycles. Readers can apply these ideas to their own goals, whether retirement, education funding, or wealth preservation, and track progress with simple metrics and periodic reviews; this approach also supports responsible financial behavior, reduces stress during market shocks, and helps you communicate with advisers and family about risk and goals.

Beyond the explicit term, readers encounter a wider landscape of market fluctuations, price swings, and market turbulence that test portfolios and decision making. By exploring signals such as volatility indices, momentum shifts, liquidity changes, and earnings surprises, you gain a nuanced view of the terrain without fixating on a single phrase. This LSI-inspired framing reinforces semantic connections among risk, diversification, hedging, capital allocation, and time horizon, helping readers and search engines recognize the topic as broad and interconnected.

Stock Market Volatility: Understanding Its Drivers and Strengthening Risk Management

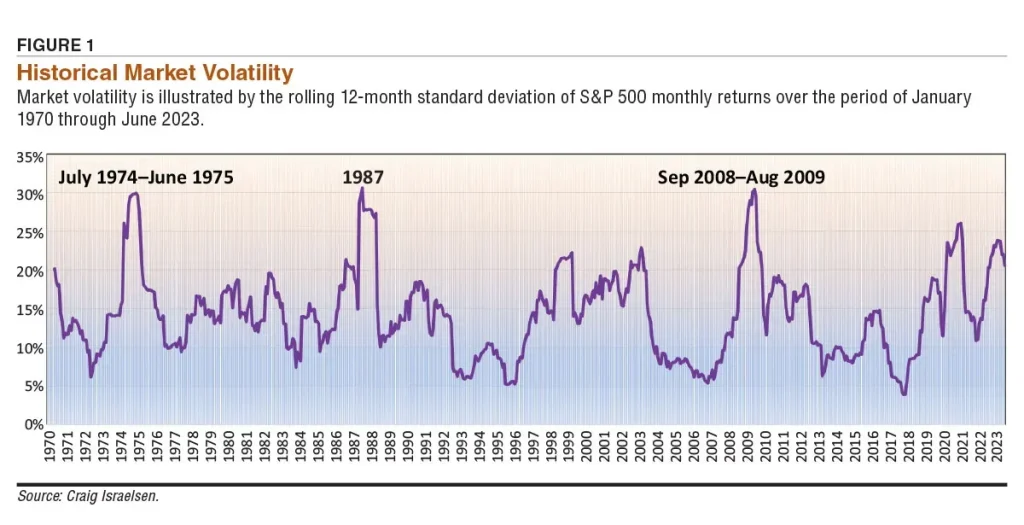

Stock Market Volatility reflects rapid price swings in equity markets over short periods. It is driven by changing expectations for corporate earnings, macroeconomic data revisions, central bank policy signals, geopolitical events, and liquidity conditions. This volatility isn’t just noise—it’s a signal that can inform a more disciplined approach to investing. By understanding these drivers and staying patient, investors can reinterpret volatility as a risk gauge and a potential opportunity for long-term planning. Indicators like the VIX help quantify expected moves, but successful strategies focus on behavior and plan, not headlines alone.

To strengthen risk management in volatile markets, start with a clear risk tolerance and time horizon, then adjust asset allocation to align with your goals. Diversification across asset classes—domestic and international equities, bonds, and real assets—reduces correlation risk and helps protect investments when one sector stumbles. Consider defensive exposure to high‑quality, cash‑generating companies, and maintain a fixed‑income ballast to cushion drawdowns. Regular rebalancing, dollar‑cost averaging, and a disciplined plan help you avoid market timing and stay committed to the long run. An emergency fund can further stabilize outcomes by providing liquidity during drawdowns, reducing the likelihood you’ll need to sell at unfavorable prices.

Portfolio Diversification and an Emergency Fund: Practical Steps to Protect Investments

Effective portfolio diversification spreads risk across asset classes and regions, reducing the impact of any single shock on your overall plan. A mix of broad stock index exposure (U.S. and international), high‑quality bonds, real assets, and selective income-producing securities helps smooth volatility while preserving growth potential. This approach supports protecting investments while maintaining a growth trajectory, and it is a core component of sound risk management and long‑term investing. By implementing a thoughtful allocation, you increase resilience against market rotations and price swings.

An explicit emergency fund further fortifies a volatility strategy by providing readily accessible cash for unexpected expenses, so you don’t have to tap investments during a downturn. Keep this reserve in liquid, low‑risk vehicles and align its size with anticipated needs, not just market scenarios. Combine diversification with dollar‑cost averaging and disciplined rebalancing, and keep costs low with broad‑market index funds and ETFs. This integrated approach—portfolio diversification paired with a robust emergency fund—helps you navigate emotions and volatility while staying focused on long‑term goals.

Frequently Asked Questions

What is Stock Market Volatility and how can I protect investments during volatile periods?

Stock Market Volatility refers to rapid and sizable price swings in equities over short timeframes. It is driven by earnings surprises, macro data, central bank policy, geopolitical events, and liquidity conditions. To protect investments during volatile periods, apply solid risk management: maintain a well-funded emergency fund, diversify across asset classes (portfolio diversification), keep costs low with broad-market index funds, avoid market timing, and stick to a disciplined plan with periodic rebalancing. By focusing on long-term goals and using defensive exposures when appropriate, you can reduce drawdowns and stay on track.

How does portfolio diversification help manage Stock Market Volatility, and what practical steps should investors take?

Portfolio diversification spreads risk across different assets, reducing the impact of any single shock on your overall portfolio during Stock Market Volatility. Practical steps include allocating across stocks, bonds, real assets, and cash, maintaining a mix of domestic and international investments, and using fixed-income ballast to smooth returns. Regularly use dollar-cost averaging, rebalance to target allocations, consider defensive sectors and high-quality holdings, and keep a deliberate emergency fund for liquidity. These actions support risk management, help protect investments, and position your portfolio to weather market swings.

| Aspect | Key Points |

|---|---|

| What it is | Stock Market Volatility refers to rapid, often large price movements in equities over short periods; measured by indicators like the VIX; driven by changing earnings expectations, macro data, central bank policy, geopolitical events, and liquidity. |

| Drivers | Economic surprises (inflation, unemployment, growth), central bank signals about interest rates, geopolitical tensions, trade policies, supply chain disruptions, liquidity conditions, and earnings surprises. |

| Impact on Investors | Varies by time horizon and risk tolerance. Short-term traders may seek to profit from swings, while long-term investors focus on goal achievement. Fear and greed can lead to emotional decisions; drawdowns may occur, but volatility also creates buying opportunities for disciplined investors. |

| Practical Strategies | Build an emergency fund; assess risk tolerance and adjust asset allocation; diversify across asset classes; use dollar-cost averaging; rebalance to target allocations; consider defensive and high-quality holdings; include fixed-income ballast; prioritize low-cost, diversified investments; manage costs and taxes; avoid market timing and stay the course. |

| A Practical Example | A volatility-resilient portfolio might blend 40–60% broad stock exposure, 30–40% high-quality bonds, 5–10% real assets or TIPS, and 5–10% cash for liquidity; rely on an emergency fund and disciplined rebalancing. |

| Behavioral Aspects | Emotions like fear and greed can influence decisions. Use pre-set rules, annual or semi-annual rebalancing, drawdown thresholds, and formal decision frameworks to reduce impulsive actions and sequence-of-returns risk. |

| Tax & Costs | Prioritize tax-efficient accounts for long-term holdings, low-turnover funds, and tax-loss harvesting when appropriate. Favor low-cost index funds and ETFs to protect net returns during volatility. |

| Time Horizon & Goals | Long horizons tolerate volatility better; align asset mix with goals and time frame to reduce impulsive changes. Clear goals guide risk tolerance and asset allocation. |

| Tools & Resources | Low-cost funds (index funds, ETFs), performance and risk tracking tools, educational resources on portfolio construction, and access to professional guidance as needed. |

Summary

Stock Market Volatility is a reality every investor faces. In turbulent times, prices swing, headlines flash, and fear can creep into decision making. But volatility isn’t just a risk to endure—it’s a signal to adapt. By understanding what drives stock market volatility and applying disciplined strategies, you can protect investments, manage risk, and position your portfolio to weather storms. This guide explores practical steps, backed by sound investing principles, to help you navigate volatility with confidence.

Conclusion

Stock Market Volatility is inevitable, but it doesn’t have to derail your plans. By implementing a disciplined risk management framework, expanding portfolio diversification, maintaining an emergency fund, and staying focused on long-term goals, you can protect investments and even position your portfolio to take advantage of opportunities as they arise. The key is not to eliminate volatility but to manage it intelligently—keeping costs low, maintaining liquidity, and consistently applying a well-structured investment plan. With patience, education, and a clear strategy, you can navigate turbulent times and come out stronger on the other side.