ETFs in the stock market have transformed how everyday investors access diversified portfolios with a single trade. These funds blend the diversification of mutual funds with the intraday flexibility of stocks, and they can help you see how ETFs work in real time. Understanding the benefits of ETFs becomes clearer when you consider diversification, which spreads risk across many securities. Compared with traditional mutual funds, ETFs often offer price transparency, liquidity, and cost efficiency, making them appealing for many investors. This guide explains what ETFs are, how they operate, and practical steps to begin using them to invest smarter.

Seen through a different lens, these instruments are often called exchange-traded funds, index funds, or tracker baskets. They aim to mirror a market index, sector, or theme while trading on an exchange like a stock, supporting flexible entry and exit. This model emphasizes passive investing, wide diversification, and cost efficiency—the core reasons behind the popularity of low-cost investing with ETFs. Compare with a traditional mutual fund, and you’ll notice that the trading price and liquidity of ETFs give investors a practical alternative to the ETF vs mutual fund decision. Seen as tools for building wealth over time, these vehicles enable ongoing contributions and rebalancing without the constraints of a single active strategy. For beginners and seasoned savers alike, the key is to align exposure with risk tolerance, maintain a core holding, and avoid overtrading while seeking steady, sustainable growth.

ETFs in the stock market: How they work, benefits, and diversification

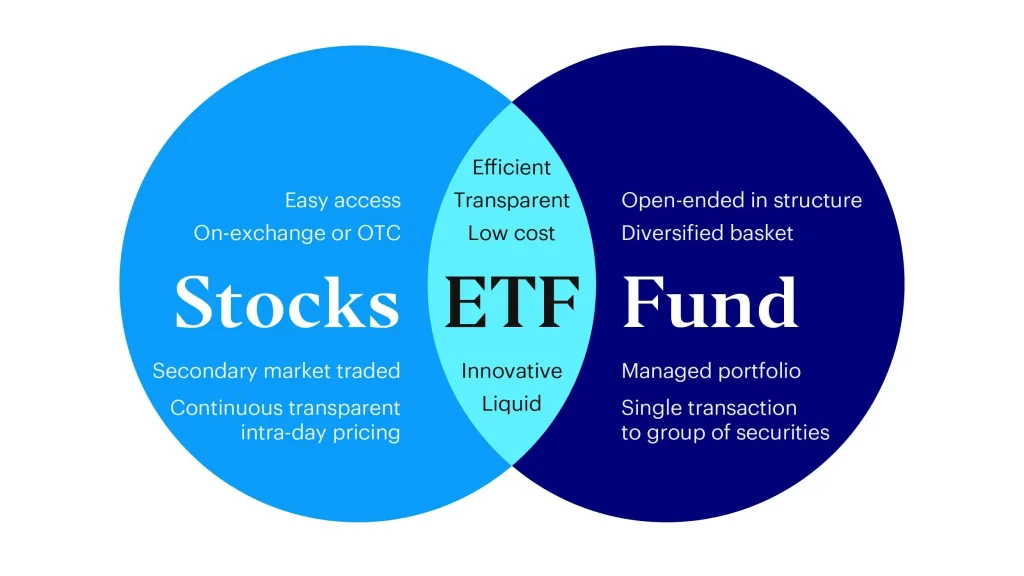

ETFs in the stock market offer a practical way to access a diversified mix of assets with a single trade. By design, an ETF is a basket of securities that tracks an index or theme and trades on an exchange like a stock, so you can buy or sell throughout the trading day. Understanding how ETFs work—including creation and redemption mechanics and the role of authorized participants—helps explain why intraday pricing and liquidity matter for investors.

Beyond structure, the benefits of ETFs make them appealing: diversification with ETFs provides exposure to hundreds of securities in a single fund, liquidity for easy entry and exit, lower costs compared with many actively managed funds, and daily transparency about holdings. These attributes support a low-cost investing with ETFs approach and offer a potential long-term advantage for many portfolios.

Choosing the Right ETFs: ETF vs mutual fund, costs, and a diversified plan

Choosing the right ETFs begins with clear goals and risk tolerance. Compare costs, tracking error, and liquidity, and distinguish between intraday trading of ETFs and the end-of-day pricing of mutual funds. The ETF vs mutual fund decision influences how you build a core position and how you manage fees over time.

To build a resilient portfolio, start with a simple core that provides broad market exposure and add complementary ETFs to expand diversification with ETFs. Focus on low-cost investing with ETFs by selecting funds with low expense ratios and high liquidity, while also considering diversification, geographic exposure, and bond or international allocations.

Frequently Asked Questions

How do ETFs in the stock market work?

ETFs in the stock market are baskets of assets designed to track a specific index, sector, or theme and traded on an exchange like a stock. They operate via creation and redemption by authorized participants to keep the price close to the index value (NAV). Prices move intraday, enabling real-time trading, while the fund aims to mirror the index. This structure offers instant diversification, liquidity, and typically lower costs compared with many mutual funds.

What are the benefits of ETFs in the stock market, and how does ETF vs mutual fund compare for diversification and cost?

Benefits of ETFs in the stock market include broad diversification with a single trade, intraday liquidity, lower expense ratios, daily holdings disclosure, and potential tax efficiency. When comparing ETF vs mutual fund, ETFs trade throughout the day with real-time prices, while mutual funds are priced once per day; ETFs often offer lower ongoing costs but may incur bid-ask spreads. For diversification with ETFs and low-cost investing with ETFs, begin with a core broad-market ETF, add international and bond ETFs, and monitor liquidity and expense ratios to maintain cost efficiency.

| Topic | Key Points |

|---|---|

| Introduction | ETFs in the stock market enable access to diversified portfolios with a single trade; ETFs combine diversification of mutual funds with the flexibility of stocks. |

| What are ETFs? | An ETF is a basket of assets designed to track an index, sector, or theme; trades on an exchange like a stock; provides instant diversification and real-time trading. |

| How ETFs work | ETFs use a creation and redemption process managed by authorized participants; aim to mirror an index; intraday price fluctuates with supply and demand; NAV is the asset value; enables precise entry/exit. |

| The benefits of ETFs | Diversification; liquidity; cost efficiency; transparency; tax efficiency; potential for long-term performance cushion. |

| ETF vs mutual fund | ETFs trade intraday; mutual funds priced once daily; consider spreads and trading costs; expense ratios are often comparable; ETFs offer straightforward diversification; mutual funds may suit active strategies. |

| Choosing the right ETFs | Start with goals and risk tolerance; use core holdings for broad exposure; assess expense ratios, tracking error, and liquidity; avoid over-concentration; consider time horizon and tax situation. |

| Common ETF types and what they do | – Broad market index ETFs provide broad exposure and a portfolio foundation. – Sector or thematic ETFs target specific industries or themes. – Bond ETFs give access to fixed income with varying durations. – International ETFs diversify geography. – Commodity/real assets ETFs offer exposure to resources like gold or oil. – Smart beta and factor ETFs aim for specific investment styles while maintaining liquidity. |

| Building a simple ETF based portfolio | Combine a broad market ETF with international and bond exposure; a starter allocation might be 40-60% total market, 20-30% international, 20-30% bonds; rebalance annually; layer in sector/thematic ETFs gradually for growth while preserving diversification. |

| Practical steps to start investing in ETFs | Define goals and risk tolerance; choose a reliable, low-cost broker; start with a simple core portfolio; monitor costs and liquidity; rebalance periodically; consider tax implications. |

| Tips and pitfalls to avoid | Avoid chasing the hottest ETF; focus on expense ratio, liquidity, and tracking error; be mindful of trading costs; understand tax implications; avoid overdiversification. |

Summary

ETFs in the stock market offer a practical, flexible path to diversified investing. By combining broad exposure with real-time trading, they help investors build resilient portfolios while keeping costs predictable. Understanding how ETFs work, choosing the right types, and maintaining a simple core allocation can empower both beginners and seasoned investors to pursue steady long-term growth with managed risk.