Daily Stock Market Analysis is a disciplined approach to understanding what price action, volume, and news signal about the broader markets, helping traders and investors see beyond short-term noise to the underlying forces driving price changes. For investors and traders alike, developing a routine for interpreting market moves helps turn daily fluctuations into actionable insights that can inform position sizing, risk checks, and the alignment of trades with a broader plan. In this guide, we will show how to apply a practical, scalable framework to the day’s activity, blending concise chart observations with relevant context from earnings, macro data, and sector rotations to build a coherent view of market mood. The goal is not to forecast every swing, but to recognize meaningful signals, assess risk, and stay focused on decisions that fit your objectives rather than chasing every headline. Whether you are laying a foundation as a beginner or refining a seasoned approach, this introduction offers a clear path to use daily analysis as a tool for disciplined, thoughtful action.

Apart from the traditional framing, you can approach this practice as a daily market snapshot, a price-action review, or a momentum check that foregrounds context over guesswork. LSI-friendly language encourages you to connect observations like price patterns, volume breadth, and momentum shifts with broader market narratives such as sector rotation and macro risk factors. By pairing concrete signals with descriptive context, beginners gain a more intuitive grasp of how shifts in sentiment and liquidity shape price movement. A practical routine can still be simple: monitor key levels, confirm signals with volume, and notice how earnings cycles, inflation data, and policy expectations color the day’s price action. Ultimately, the aim is to translate raw data into meaningful stories that guide deliberate decisions, even when the market feels noisy or uncertain.

Daily Stock Market Analysis: A Practical Framework for Interpreting Market Moves

Daily stock market analysis goes beyond watching ticker symbols; it provides a disciplined method to translate price action, volume, and news into a narrative about supply and demand, momentum, and potential turning points. Framing the day around this process helps you convert fluctuations into actionable stock market insights, guiding decisions without getting overwhelmed by noise. The goal is to recognize meaningful signals, assess risk, and align daily actions with your broader investment plan.

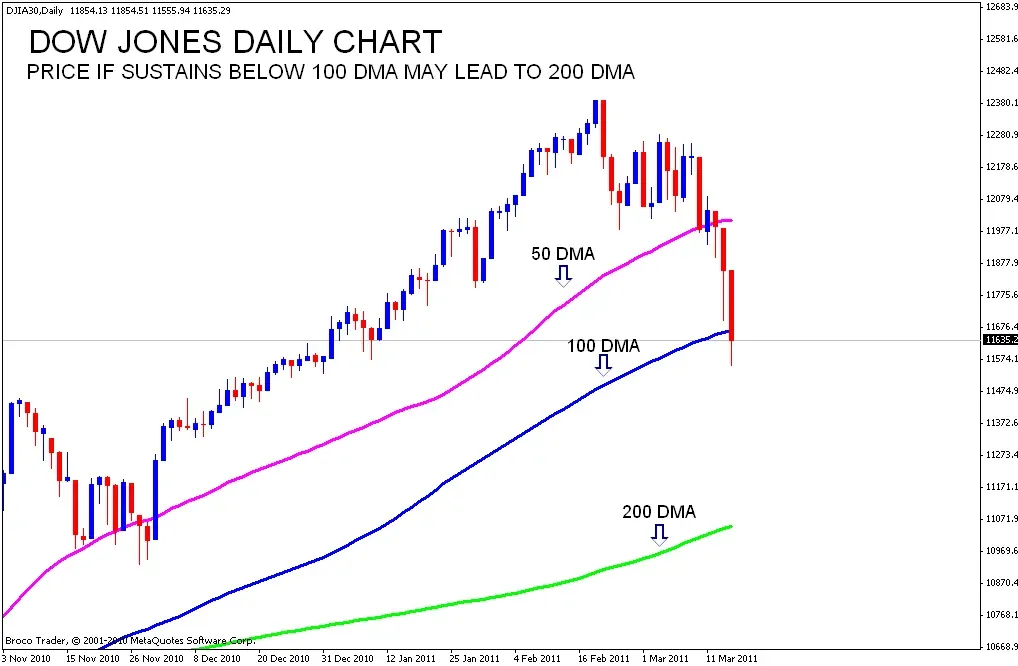

A practical daily framework blends technical observations with contextual factors. Focus on price action, breadth, and a handful of reliable indicators to form a grounded view of whether the market is in a risk-on or risk-off state. Tools such as moving averages, momentum oscillators, and volume patterns support interpretation while reminding you to consider macro news, earnings activity, and geopolitical developments that can amplify or mute signal strength.

Implementing this framework requires a repeatable routine: pre-market checks, chart review, volume and breadth assessment, momentum checks, and a clear risk plan. When a legitimate setup emerges—like a breakout with solid volume and supportive breadth—you can size a position according to your risk parameters. If the day lacks a clear edge, preserving capital and sticking to your plan is the wiser path. This approach turns daily analysis into consistent, repeatable decision-making.

Interpreting Market Moves: From Signals to Strategy with Market Trends and Indicators

Interpreting market moves means weighing multiple signals to form a coherent view of the day’s mood. Recognize common patterns such as rising-volume uptrends, breakouts above resistance, and healthy pullbacks near key moving averages. Divergences between price and momentum can warn of weakening momentum, while sector leadership shifts signal broader health or risk sentiment. Throughout, the aim is to corroborate signals across indicators rather than rely on any single clue.

For beginners and seasoned readers alike, a measured approach to interpreting moves reduces noise and improves confidence. Start by mapping price action to simple states—uptrend, downtrend, or range—and gradually add context from breadth, sector performance, and macro narrative. This blend of stock market insights with a disciplined routine helps you translate raw data into actionable decisions that align with your risk tolerance and long-term goals.

Common pitfalls—such as overreacting to headlines or chasing moves after they happen—typically derail daily analysis. By keeping perspective, documenting outcomes, and focusing on market trends and indicators within a broader framework, you maintain coherence between signals and your investment plan. With consistent practice, interpreting market moves becomes a skill that supports deliberate, not impulsive, daily decisions.

Frequently Asked Questions

What is Daily Stock Market Analysis and how can beginners use it to gain stock market insights?

Daily Stock Market Analysis is a disciplined approach to translating price action, volume, and relevant news into a concise narrative about market mood. It blends technical observations with context to help you interpret daily moves and avoid overreacting. For beginners, start with a simple, repeatable routine: pre-market scan, chart review, volume check, indicator check, and a risk-aligned plan that fits your longer-term strategy. The goal is to uncover meaningful signals and gain stock market insights that you can act on, rather than trying to predict every swing.

Which indicators and patterns should I focus on in Daily Stock Market Analysis to improve interpreting market moves?

In Daily Stock Market Analysis, focus on price action and chart patterns, volume and breadth, moving averages, and momentum tools such as RSI and MACD, all within the broader context of market trends and indicators. Look for uptrends with strong volume, breakouts supported by participation, healthy pullbacks near key moving averages, and potential divergences between price and momentum. Remember to corroborate signals across multiple indicators rather than relying on a single cue, and keep your interpretation aligned with the day’s market moves to improve interpreting market moves and generate clearer stock market insights.

| Key Point | Summary |

|---|---|

| Purpose and scope | Daily Stock Market Analysis is a disciplined approach to interpreting price action, volume, and news to gain actionable insights, aiming to recognize meaningful signals and align with your investment plan rather than predicting every swing. |

| Core components | Focus on price action, volume/breadth, moving averages, momentum tools (RSI, MACD), and relevant market context to form a grounded view of daily market mood and risk. |

| Practical indicators | Key tools include price action and chart patterns, volume/breadth, moving averages, momentum indicators, and macro context that can amplify or dampen price moves. |

| Pattern interpretation | Interpret signals such as uptrends with rising volume, breakouts above resistance, healthy pullbacks near moving averages, divergences, and sector leadership shifts; corroborate with multiple indicators to avoid overfitting. |

| Daily routine | Pre-market check, chart review, volume/breadth scan, indicator check, news/earnings context, and a risk-management plan to create a repeatable, scalable process. |

| Guidance for beginners | Start with basics: observe price action and confirm with volume, map observations to uptrend/downtrend/range, then gradually add breadth, sector performance, and macro narrative. |

| Common pitfalls | Overreacting to headlines, chasing moves after they happen, and relying on a single indicator; view the daily snapshot as part of a larger story and align with risk tolerance and long-term goals. |

| Real-world application | When a legitimate setup emerges (e.g., price breakout with strong volume and breadth), consider a measured position; in quiet markets, preserve capital and document outcomes to refine your approach. |

| Tools and consistency | Utilize charting platforms with multi-timeframe views, an economic calendar, news/earnings feeds, and a journaling process to maintain a clear, repeatable routine. |

Summary

Conclusion: Daily Stock Market Analysis bridges raw price data and informed decision-making through a structured routine that interprets market moves with discipline. By focusing on price action, volume, and relevant news within a scalable framework, investors and traders can recognize meaningful signals, assess risk, and align actions with their broader plan. This description emphasizes preparation, disciplined observation, and risk-aware action, helping readers stay ahead of market moves and act with purpose rather than impulse. The Daily Stock Market Analysis approach supports both beginners building a foundation and seasoned practitioners seeking consistency in daily decision-making.