Total Cost of Ownership for Automobiles provides a clearer view of what you pay beyond the sticker price, shaping smarter buying and budgeting decisions. A practical framework weighs total cost of ownership for cars alongside car maintenance costs, depreciation, and financing, so you see the full picture. Understanding vehicle depreciation helps explain why it’s often the largest expense in early years and guides choices like buying used or certified pre-owned. Considering tax implications of owning a car varies by location and vehicle choice, impacting the long-term affordability as much as fuel or insurance. If you’re looking to curb expenses, the guide highlights how to lower car ownership costs through smart shopping, maintenance discipline, and fuel-efficient choices.

Seen through the lens of lifecycle costs, owning a vehicle involves more than the sticker price, including ongoing expenses that accumulate over time. By focusing on overall ownership expense, you can weigh depreciation, upkeep, insurance, taxes, and fuel as a cohesive package rather than isolated bills. This latent semantic approach uses related concepts such as vehicle depreciation, maintenance cost trajectories, and financing charges to map the true cost of a car across years. Understanding these alternative terms helps shoppers compare options—whether new, used, or hybrid—by total lifetime cost and long-term value rather than just the upfront price.

Total Cost of Ownership for Automobiles: Understanding the True Price Beyond the Sticker

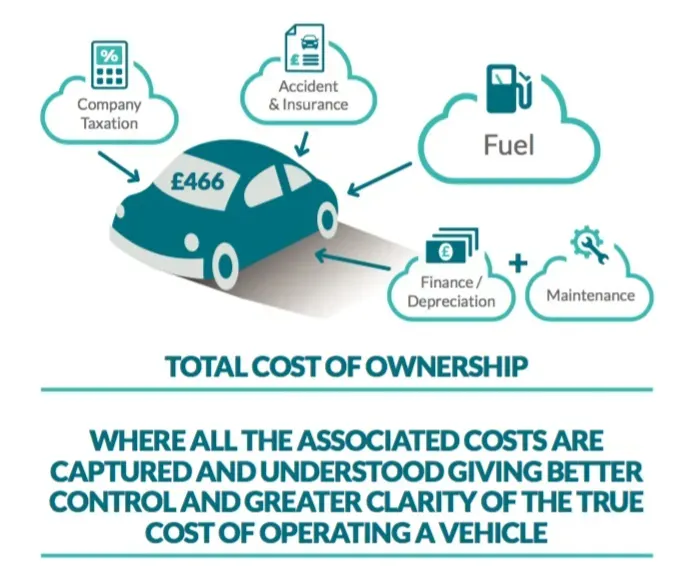

The Total Cost of Ownership for Automobiles captures every financial impact from the moment you sign the deal to the day you trade in or sell the vehicle. Beyond the sticker price, depreciation often stands as the single largest cost, but you must also account for financing charges, taxes, insurance, maintenance, fuel, and even the opportunity cost of tying money into a car. By considering all these elements together, you gain a clearer view of the true expense of car ownership and can compare options more effectively. The term total cost of ownership for cars highlights that money spent over time matters as much as the upfront price.

To evaluate TCO, you should track maintenance costs, depreciation trajectories, insurance quotes, tax implications of owning a car, and fuel efficiency. Planning for routine service, selecting reliable models with strong resale value, and choosing the right financing strategy are practical steps to improve the bottom line. This is where the idea of how to lower car ownership costs comes into play, guiding you toward purchases and plans that minimize long-term spending without sacrificing safety or reliability.

How to Lower Car Ownership Costs: Practical Strategies to Reduce Your TCO

If reducing the total cost of ownership is a priority, start with choices that reduce the biggest drains on your budget: depreciation and ongoing maintenance. Opting for fuel-efficient, reliable models, considering certified pre-owned options, and avoiding excessive add-ons can markedly cut the depreciation curve and maintenance burden. Coupled with prudent financing terms and a realistic maintenance reserve, these moves set a foundation for lower overall costs while preserving performance.

Beyond the vehicle itself, pay attention to tax implications of owning a car and regional fees that can quietly inflate TCO. Compare insurance quotes based on model safety and your driving profile, and plan for fuel costs by selecting engines and drivetrains with favorable real-world economy. By researching total ownership costs across different vehicle types and planning ahead, you can make smarter decisions that align with your budget and lifestyle.

Frequently Asked Questions

What is the Total Cost of Ownership for Automobiles, and how do car maintenance costs and vehicle depreciation influence the true cost of owning a vehicle?

The Total Cost of Ownership for Automobiles is the complete financial picture of owning a car from purchase to resale. It includes purchase price and financing, depreciation (often the largest expense), taxes, fees, insurance, maintenance, fuel, and resale value. Car maintenance costs and vehicle depreciation heavily shape the total cost: skipping scheduled service can trigger bigger repairs and faster depreciation. To manage them, follow the manufacturer’s maintenance schedule, choose fuel-efficient and reliable models, consider certified pre-owned to reduce depreciation, compare total ownership costs—not just the sticker price—and keep thorough service records to protect resale value.

How can you lower car ownership costs within the Total Cost of Ownership for Automobiles framework, considering tax implications of owning a car and strategies to reduce maintenance and depreciation?

Lowering car ownership costs starts with broad costing, not just the sticker price. Practical steps include: buy smart by comparing total ownership costs across models and considering used or certified pre-owned vehicles to limit depreciation; prioritize fuel efficiency to reduce ongoing fuel costs; plan financing carefully (e.g., longer-term loans at reasonable rates while keeping total interest affordable); build a maintenance reserve and follow scheduled service to avoid expensive repairs; choose reliable models with strong resale value; and account for taxes, fees, and registration in your location—and look for any tax implications or incentives that can lower the long-term bill. Keeping up with maintenance and record-keeping also supports higher resale value at sale or trade-in.

| Key Point | Description |

|---|---|

| Definition / Scope | TCO for Automobiles encompasses all costs from purchase to disposal, not just the sticker price, including maintenance, depreciation, taxes, insurance, fuel, and other related expenses. |

| Purchase price and financing | Upfront price plus interest or lease payments. |

| Depreciation | Value loss over time; often the largest cost, especially for new cars. |

| Taxes, fees, and registration | Sales tax, title and registration fees, annual taxes; varies by location. |

| Insurance | Premiums depend on model, safety features, driver history, location; higher-value cars often cost more. |

| Maintenance and repairs | Routine service, wear items, tires, brakes; regular maintenance reduces big repair bills. |

| Fuel costs | Influenced by fuel economy, driving patterns, and fuel prices; efficient models save money. |

| Opportunity costs and resale value | Money you could have earned elsewhere and how resale value affects overall spend. |

| Strategies to lower TCO | Buy smart by comparing total ownership costs; consider used/CPO; prioritize fuel efficiency; plan maintenance; compare costs across vehicle types; smart financing. |

| 5-Year example (illustrative) | A simplified scenario showing purchase price, depreciation, maintenance, insurance, fuel, and taxes to illustrate approximate total cost of ownership over five years. |

Summary

Total Cost of Ownership for Automobiles is a practical framework for evaluating how much a vehicle truly costs over its life, beyond the sticker price. By examining maintenance, depreciation, taxes and fees, insurance, and fuel, you can compare options on a holistic basis and plan a budget that fits your needs. This approach helps buyers identify vehicles with lower depreciation risk, reliable maintenance, and efficient fuel economy, while avoiding unexpected costs. With proactive planning and disciplined upkeep, you can minimize the total ownership burden and enjoy dependable transportation aligned with your financial goals.